US 30 forecast: the index resumes growth

The US 30 index sees increased volatility, with the uptrend prevailing once again. The US 30 forecast for today is positive.

US 30 forecast: key takeaways

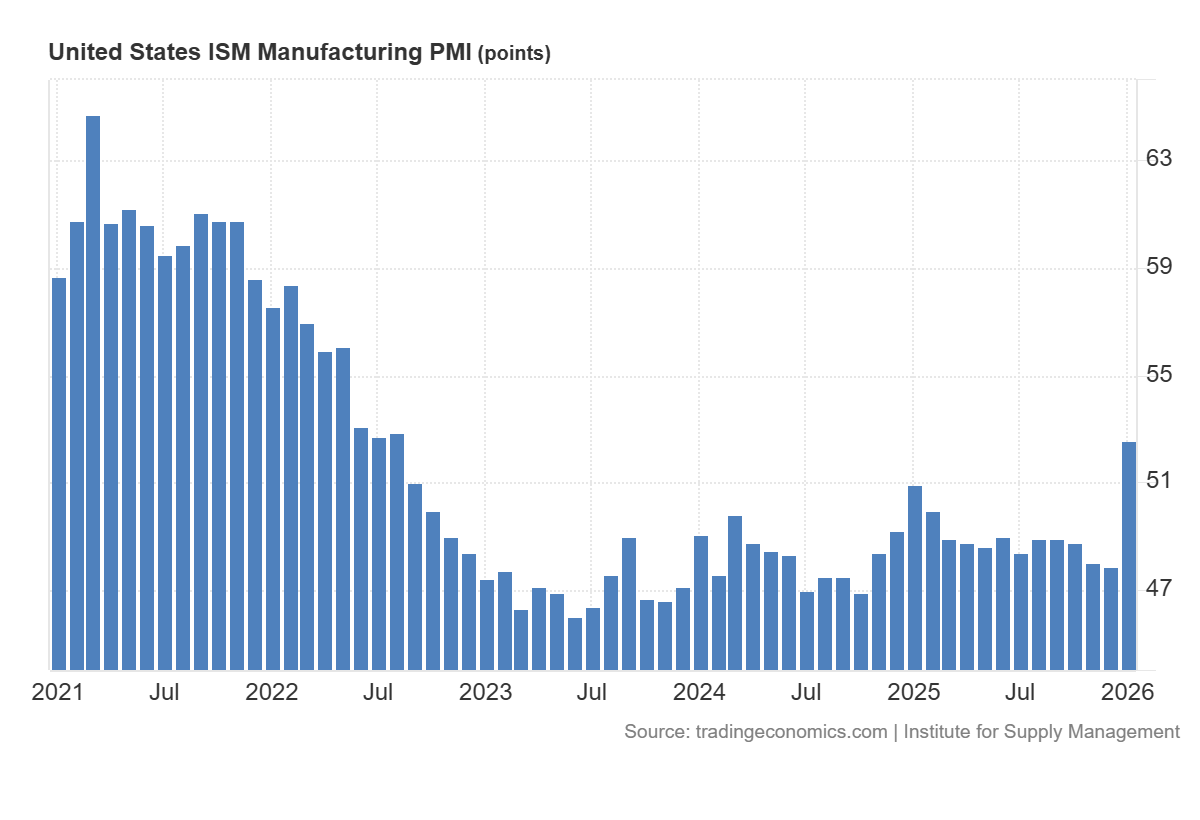

- Recent data: US ISM manufacturing PMI came in at 52.6 in December

- Market impact: the data has a moderately positive impact on the stock market

US 30 fundamental analysis

The rise in the ISM manufacturing PMI to 52.6 points, the highest level in approximately the past 40 months and well above the forecast and the previous reading, indicates a transition of the US industrial sector from contraction to expansion. For financial markets, this is an important leading signal, as the ISM index traditionally correlates well with trends in business activity, corporate earnings, and investment cycles.

For the US 30 index, this news is generally positive. The index is heavily weighted towards real-sector companies and cyclical businesses that are sensitive to industrial conditions, domestic demand, and capital expenditures. Improved production and new orders indicators increase expectations for revenue and operating profits of such companies, supporting the index quotes.

US ISM manufacturing PMI: https://tradingeconomics.com/united-states/business-confidenceUS 30 technical analysis

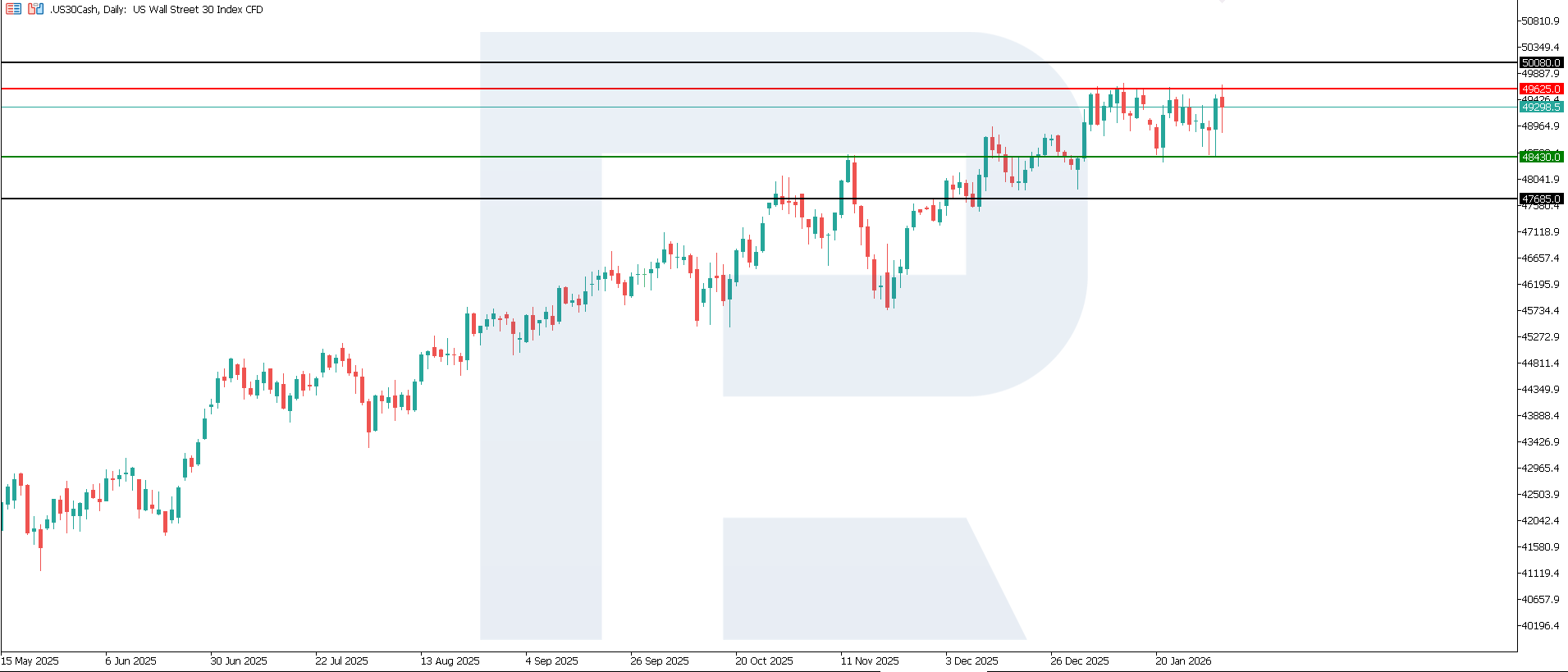

The US 30 index has entered an upward phase, with a key support level around 48,430.0 and a resistance level shifting to 49,625.0. The nearest upside target is located near 50,080.0.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: a breakout below the 48,430.0 support level could send the index down to 47,685.0

- Optimistic US 30 scenario: a breakout above the 49,625.0 resistance level could propel the index to 50,080.0

Summary

Overall, the strong ISM manufacturing PMI reading is a positive macroeconomic signal for the US 30 index and the US stock market, confirming a recovery in the industrial cycle. However, further dynamics will depend on the sustainability of this improvement in the coming months and on whether the acceleration in economic activity leads to a revision of interest rate and financial conditions expectations. The near-term upside target may be the 50,080.0 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.