US 30 forecast: the index has completed its correction but is not yet ready to rise further

After reaching its all-time high, the US 30 index is undergoing a correction. The US 30 forecast for today is positive.

US 30 forecast: key takeaways

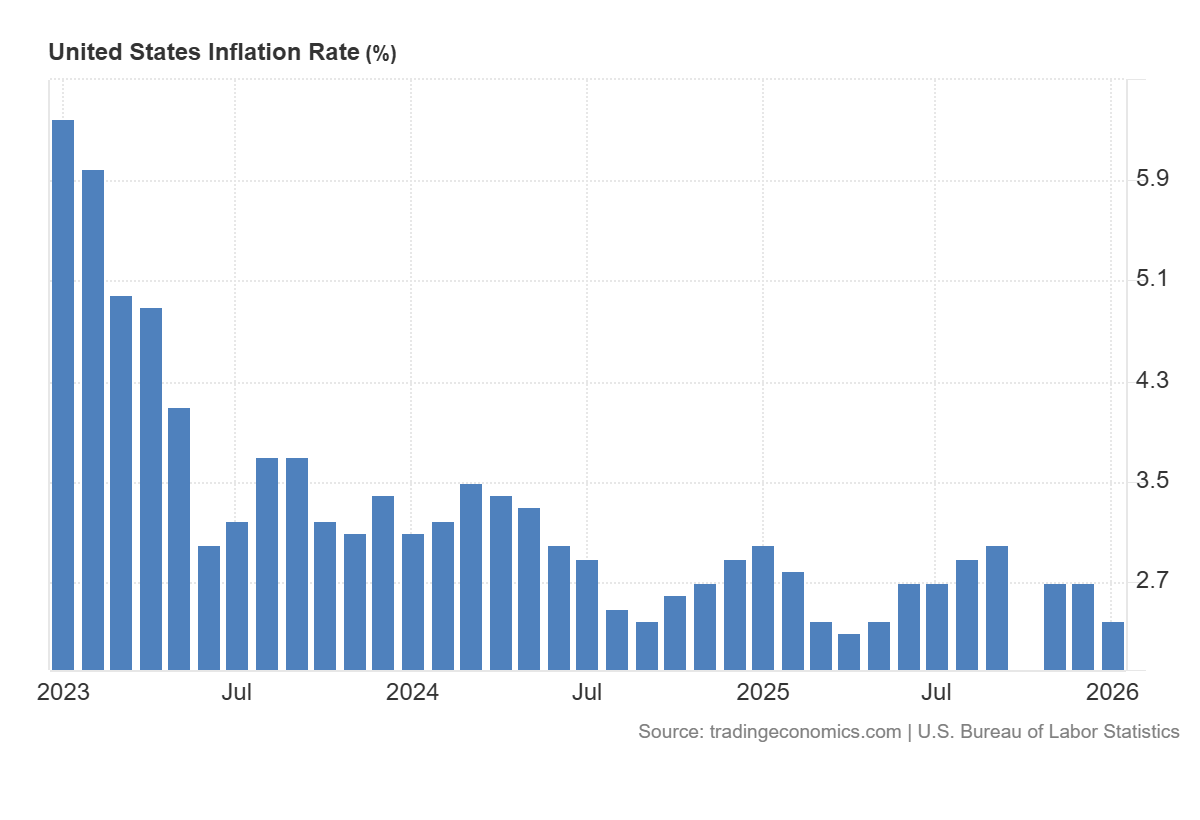

- Recent data: US CPI for January came in at 2.4%

- Market impact: the data is positive for the equity market

US 30 fundamental analysis

The release of January US CPI data forms a generally favourable yet mixed signal for the US 30 index. Annual inflation slowed to 2.4% versus a forecast of 2.5% and a previous reading of 2.7%, while the monthly CPI increase stood at 0.2%. At the same time, the core index excluding food and energy rose by 0.3% month-on-month and 2.5% year-on-year, indicating that disinflation continues but remains incomplete.

For the US 30, interest rate expectations and government bond yields are key. Softer CPI data fuelled expectations of Federal Reserve policy easing, pushing lower 10-year Treasury yields, which typically supports valuations of large-cap companies. On the release day, the market reaction was moderate.

US inflation rate: https://tradingeconomics.com/united-states/inflation-cpiUS 30 technical analysis

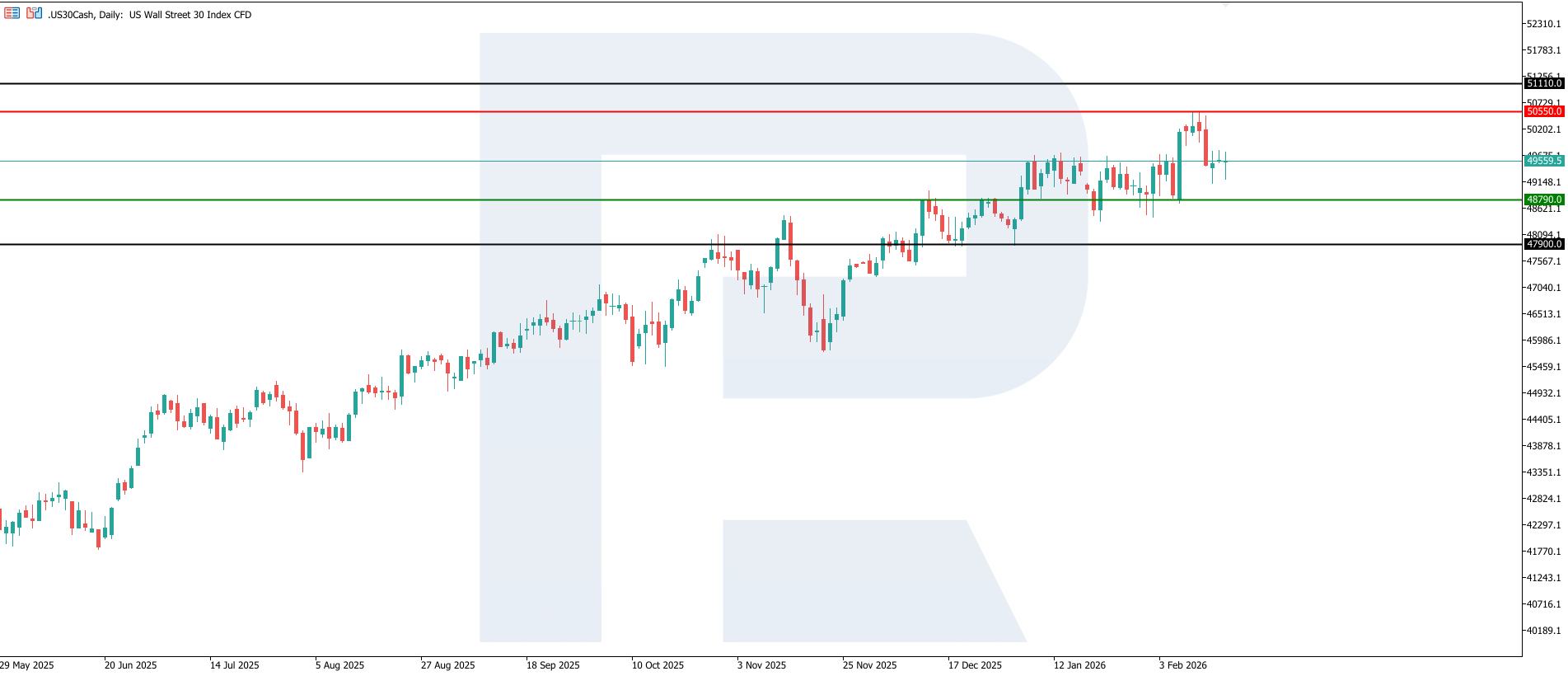

The US 30 index has entered an uptrend, with a key support level at 48,790.0 and a resistance level at 50,550.0. There is a risk of a sideways channel forming. The nearest upside target is located near 51,110.0.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: a breakout below the 48,790.0 support level could send the index down to 47,900.0

- Optimistic US 30 scenario: a breakout above the 50,550.0 resistance level could propel the index to 51,110.0

Summary

For the US 30 index, the current release supports a baseline scenario of gradual stabilisation rather than a sharp rally. The macroeconomic backdrop has improved as inflation moves towards the Federal Reserve’s 2% target, but confirmation of a sustained trend will require several consecutive releases. Therefore, the index’s further trajectory will likely be determined by a combination of upcoming inflation and labour market data, as well as the Fed’s commentary on interest rates. The nearest upside target could be 51,110.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.