US 500 forecast: the index corrected but continues to rise

After a correction, the US 500 continues to rise. However, if the support level is broken, the trend may shift back to a downward one. The US 500 forecast for today is positive.

US 500 forecast: key trading points

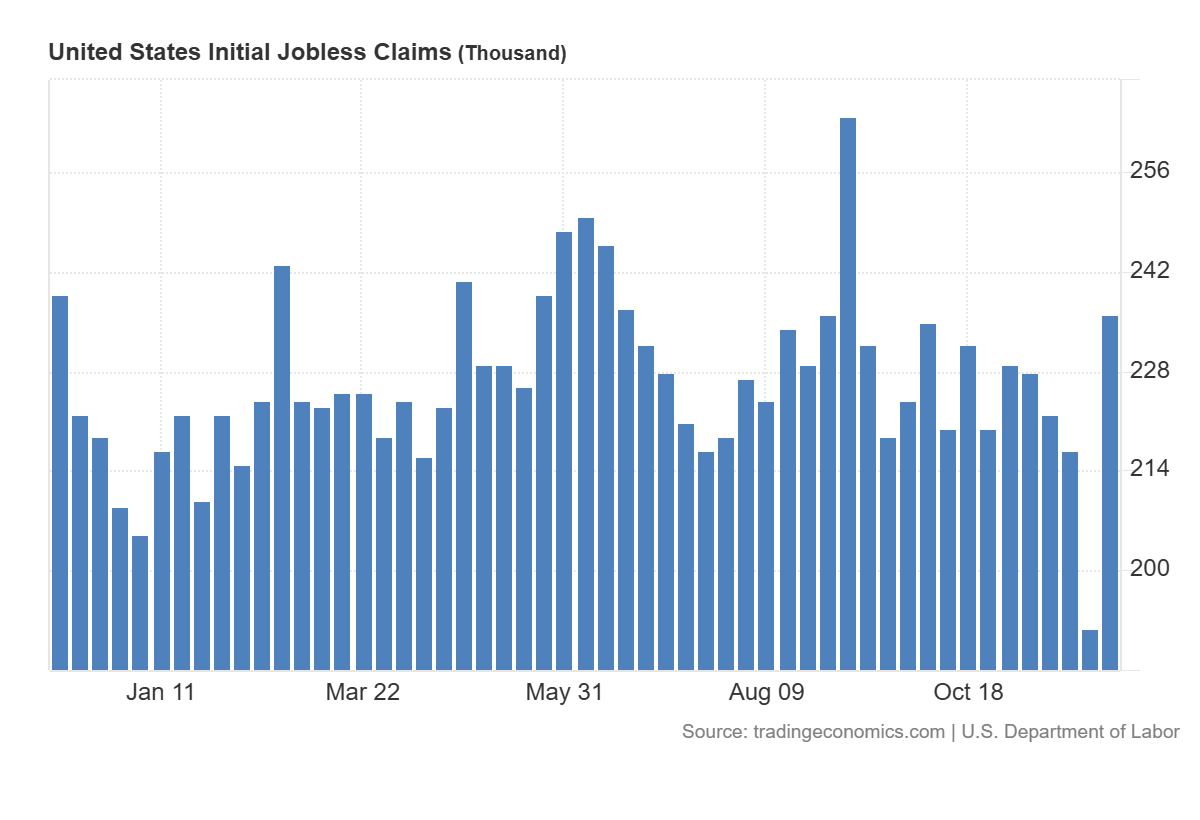

- Recent data: U.S. Initial Jobless Claims came in at 236K

- Market impact: the data is rather positive for the equity market

US 500 fundamental analysis

According to the U.S. Initial Jobless Claims release, the number of new unemployment benefit applications rose to 236K, compared with expectations of 220K and 192K the previous week. This indicates that layoffs (or job losses prompting benefit claims) increased more than the market anticipated. For the U.S. stock market, this indicator is important because it provides a timely snapshot of labour market resilience. Rising claims are an early signal that companies are becoming more cautious with hiring and are starting to reduce staff more actively. While the absolute level of 236K does not look alarming, the sharp increase from the prior week and the overshoot versus forecasts increase market anxiety, as investors begin to price in the risk that the economy may be cooling faster than expected.

For the US 500 index, the impact of this data is mixed. Some market participants will interpret the figures as increasing the likelihood of a more accommodative Federal Reserve policy, while others will view them as a sign of deteriorating economic momentum, which pressures earnings expectations. The key factor will be the reaction in the bond market and whether investors ultimately embrace the economic slowdown narrative.

United States Initial Jobless Claims: https://tradingeconomics.com/united-states/jobless-claimsUS 500 technical analysis

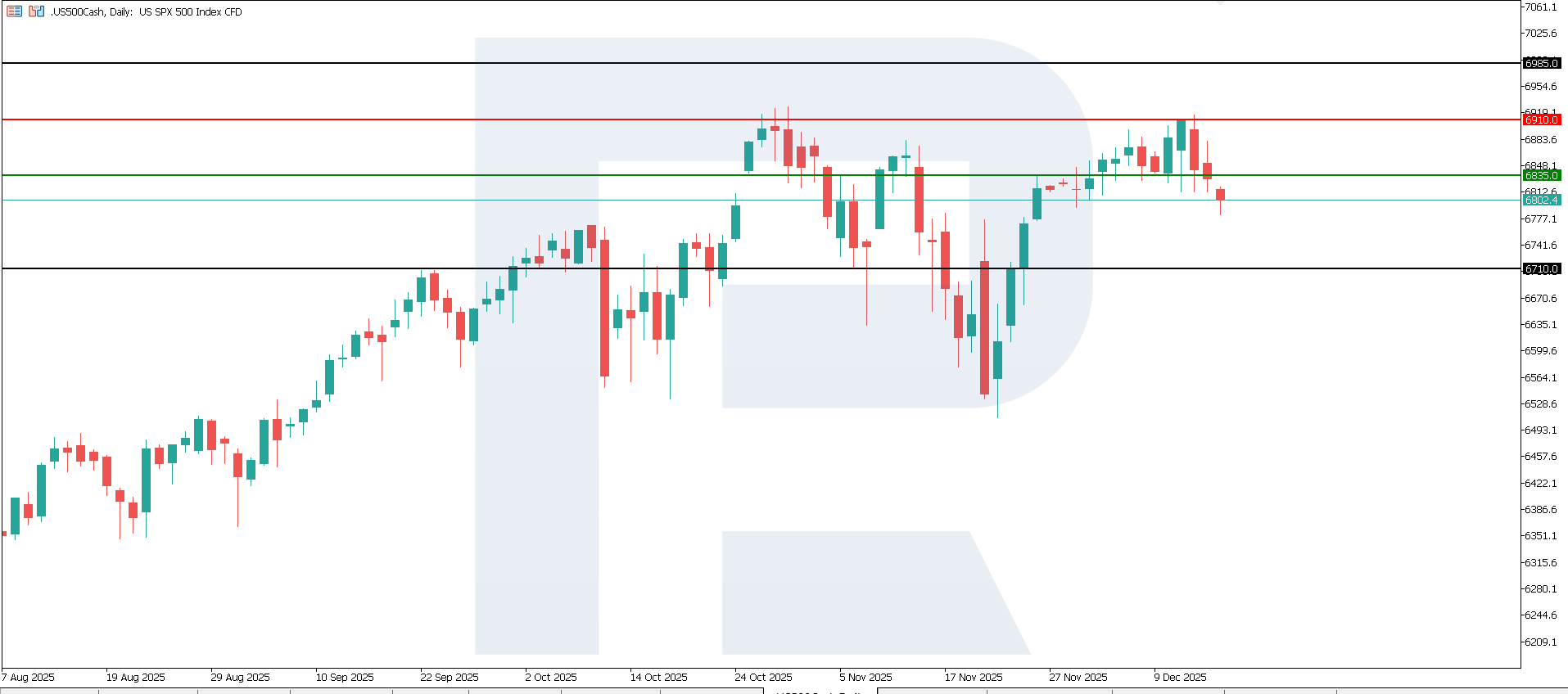

The US 500 has formed a resistance level at 6,910.0. Support at 6,835.0 has been broken. The index has undergone a correction that resulted in a shift toward a downward trend. The potential downside target is located near 6,710.0.

Forecast scenarios for the US 500:

- Bearish scenario: if the index consolidates below the broken support at 6,835.0, prices may fall toward 6,710.0

- Bullish scenario: if the index breaks above resistance at 6,910.0, prices may rise to 6,985.0

Summary

Taking into account the recent Federal Reserve rate cut, the latest jobless claims data sends a moderately negative signal for economic growth, while simultaneously increasing the probability of further rate reductions. For the US 500, the overall balance will depend on whether this trend is confirmed. If upcoming releases show that claims remain elevated or continue to rise, investors are likely to become more concerned about corporate earnings, and the index may come under pressure. From a technical perspective, the US 500 may decline toward 6,710.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.