US 500 forecast: the index has reached new all-time high

The US 500 has hit a new all-time high and continues to rise. The US 500 forecast for today is positive.

US 500 forecast: key takeaways

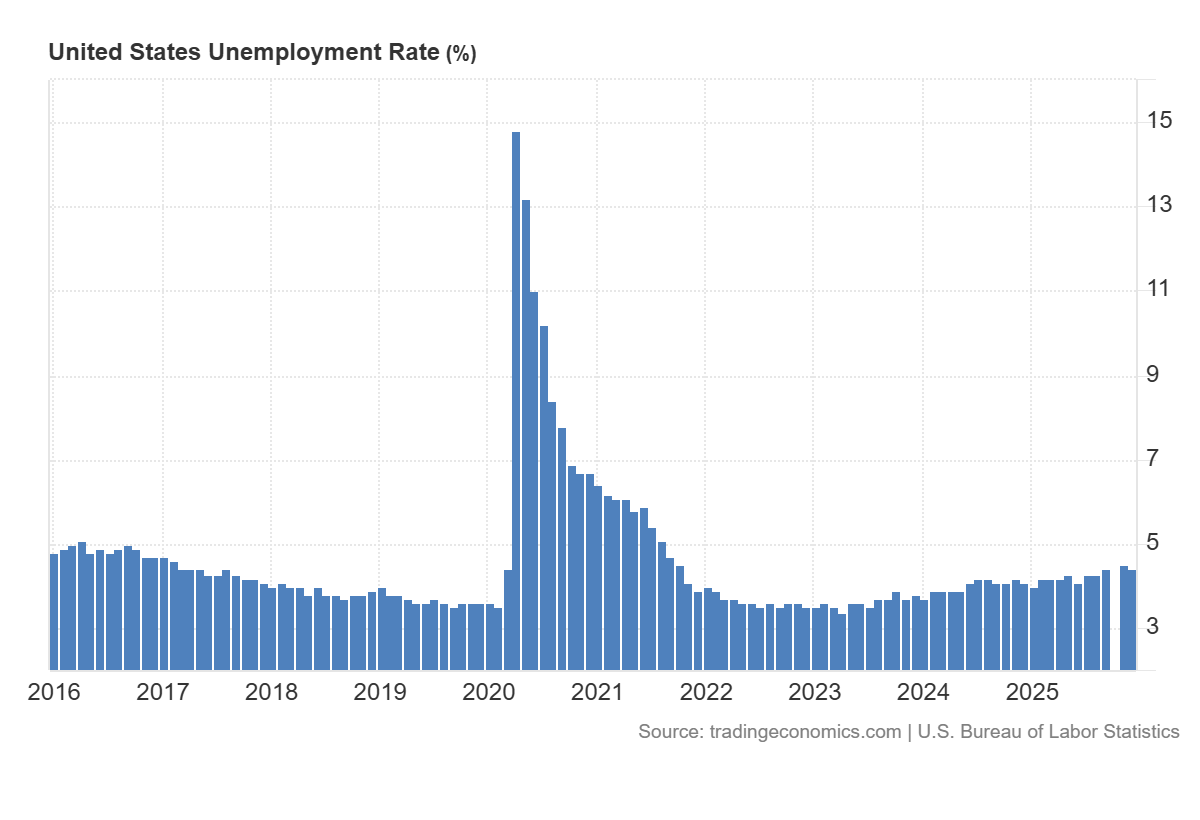

- Recent data: US unemployment rate declined to 4.4% in December

- Market impact: the data is moderately positive for the equity market

US 500 fundamental analysis

The US unemployment rate declined to 4.4%, compared with a forecast of 4.5% and a previous reading of 4.5%, indicating that the labour market is slightly stronger than expected. For the equity market, this news has a dual effect. On the one hand, lower unemployment suggests more resilient demand in the economy and a lower probability of a sharp deterioration in corporate earnings over the coming quarters, which typically supports risk appetite. On the other hand, a strong labour market increases investor sensitivity to inflation risks and may reduce expectations for an imminent and aggressive easing of Federal Reserve policy.

For the US 500 index, the effect is usually moderate and is reflected more in the structure of the movement than in a sharp impulse for the index itself. A slight improvement in unemployment supports consumer demand and revenue expectations for companies, which is favourable for cyclical sectors and parts of the financial sector. At the same time, segments of the index with a high concentration of growth companies may come under pressure if Treasury yields rise and the market begins to price in a slower pace of monetary easing by the Federal Reserve.

US unemployment rate: https://tradingeconomics.com/united-states/unemployment-rateUS 500 technical analysis

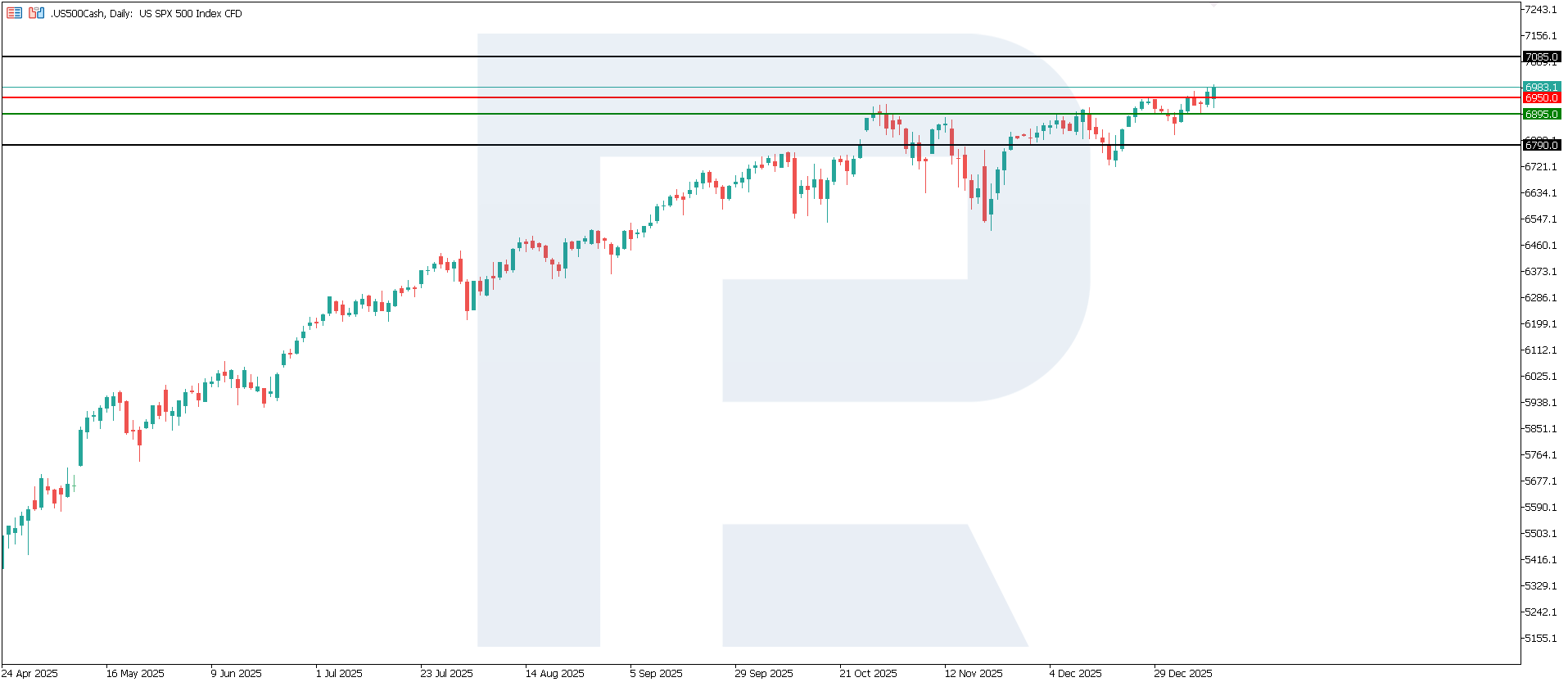

The US 500 index has broken above the 6,950.0 resistance level. The support level has formed at 6,895.0. The index is in an uptrend, with the potential upside target near 7,085.0.

The US 500 price forecast considers the following scenarios:

- Pessimistic US 500 forecast: a breakout below the 6,895.0 support level could send the index down to 6,790.0

- Optimistic US 500 forecast: if prices consolidate above the previously breached resistance level at 6,950.0, the index could advance to 7,085.0

Summary

The decline in unemployment to 4.4% is generally a constructive signal for US equities, as it reduces recession risks. At the same time, it slightly increases the likelihood of a more cautious stance from the Federal Reserve. Therefore, a moderate, mixed effect with possible sector rotation is more likely for the US 500 index, rather than a clear, strong rally. From a technical perspective, the US 500 index may rise towards 7,085.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.