US 500 forecast: the index continues to rise and may change trend

The US 500 is recovering but remains in a downtrend. The US 500 forecast for today is positive.

US 500 forecast: key takeaways

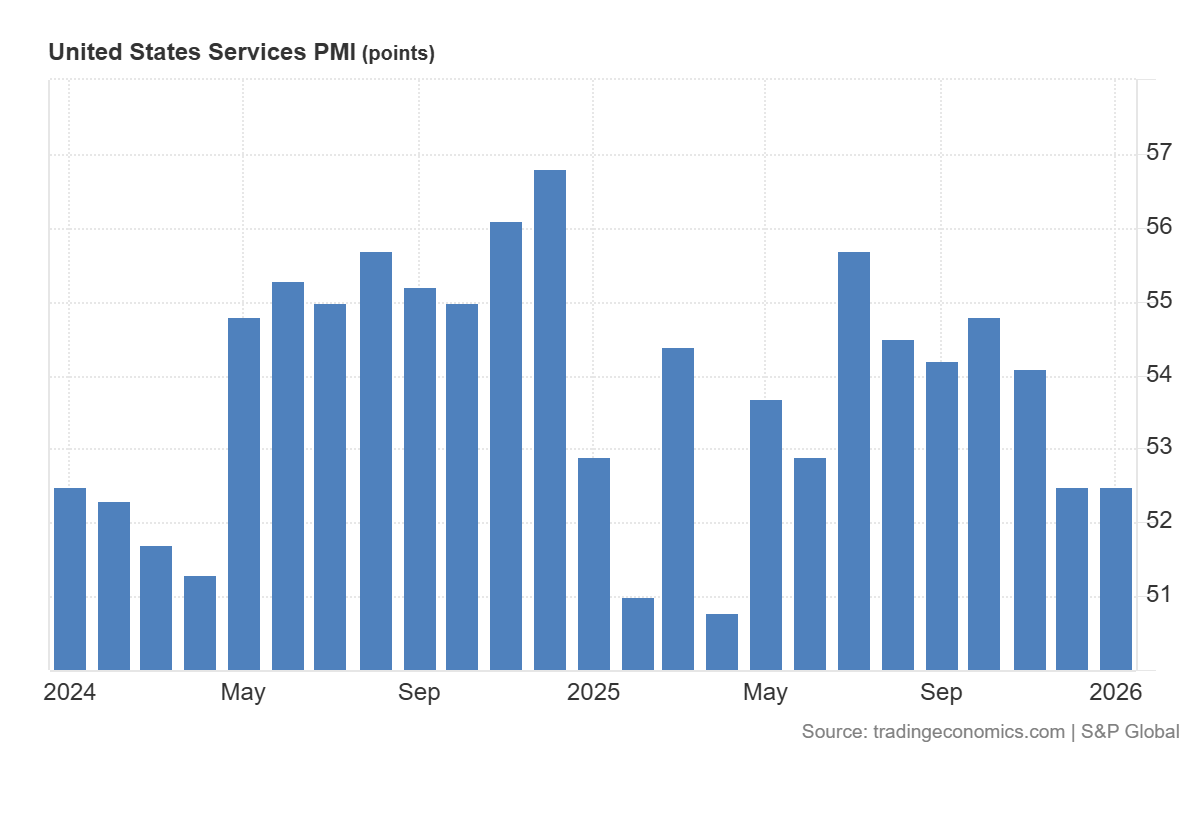

- Recent data: US services PMI for December came in at 52.5

- Market impact: the data is moderately positive for the equity market

US 500 fundamental analysis

The services PMI index reflects how companies assess current business conditions, including demand, order volumes, employment, and overall activity dynamics. The 50 level separates expansion from contraction, so a reading of 52.5 indicates that the US services sector continues to expand. This is important for the equity market because services account for a large share of the US economy and indirectly influence revenue and profit expectations for most public companies and interest rate expectations.

For the US 500 index, this suggests that strong upward momentum from this release alone is unlikely, and the baseline reaction is closer to neutral or slightly negative if the market was expecting a stronger reading ahead of the publication. If market participants conclude that growth in services is sustainable and inflationary pressures may persist, bond yields could rise, which would typically have a restraining effect on the US 500. If, however, the focus is on the fact that the indicator did not exceed the forecast and does not strengthen the case for a more restrictive Federal Reserve policy, this will negatively affect the stock market.

US services PMI: https://tradingeconomics.com/united-states/services-pmiUS 500 technical analysis

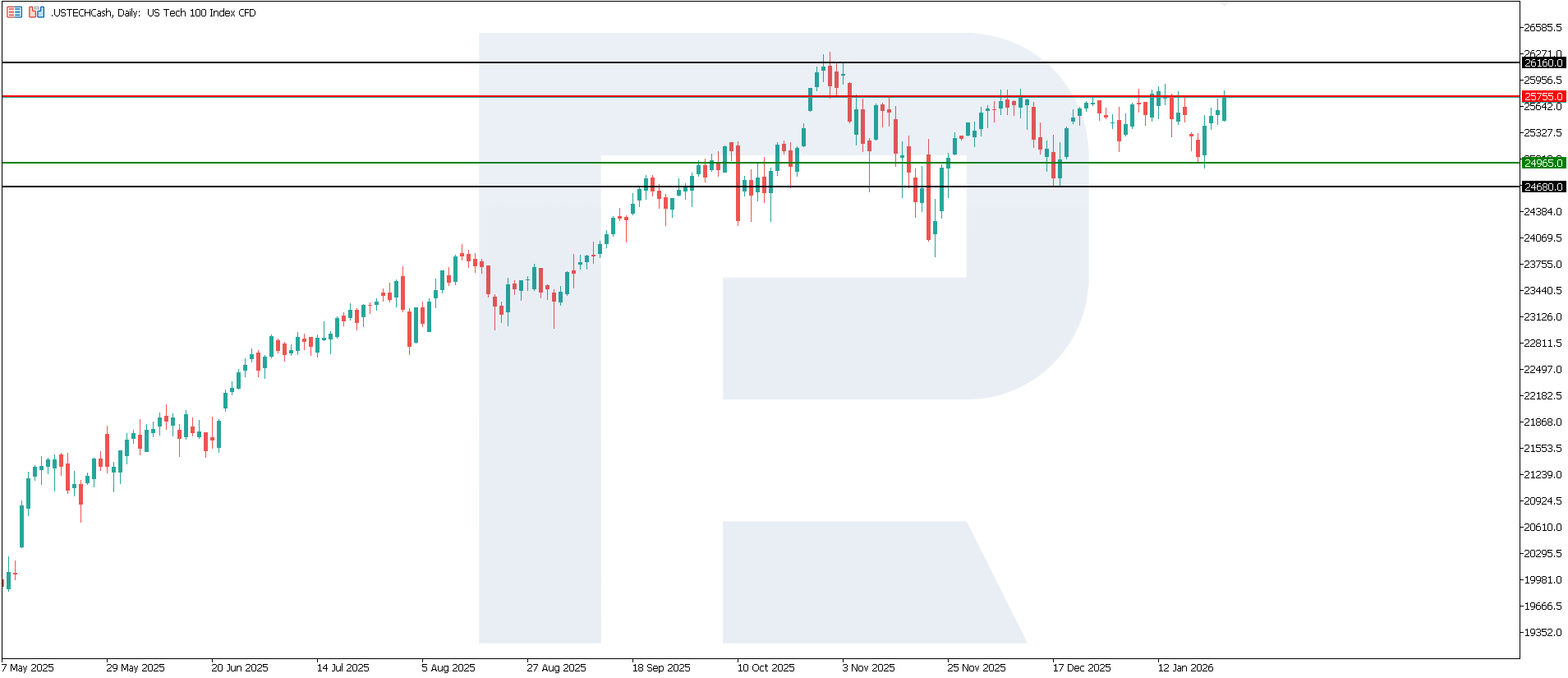

The US 500 index has formed a support level at 6,790.0 and a resistance level at 6,985.0. The index is in a corrective uptrend, with the potential upside target around 7,085.0.

The US 500 price forecast considers the following scenarios:

- Pessimistic US 500 forecast: a breakout below the 6,790.0 support level could send the index down to 6,725.0

- Optimistic US 500 forecast: a breakout above the 6,985.0 resistance level could boost the index to 7,085.0

Summary

The latest services PMI release points to continued moderate growth in the US economy, but without improvement and slightly below expectations. For the US 500, this is typically a neutral signal with a slight negative bias in the near term, while the final impact depends on the reaction of the bond market and any reassessment of expectations for the Federal Reserve’s rate path. With such a small deviation from the forecast, a limited market response is most likely. From a technical perspective, the US 500 index may rise to 7,085.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.