US 500 forecast: the index hits new all-time high

The US 500 has reached a new all-time high and entered a correction phase. The US 500 forecast for today is positive.

US 500 forecast: key takeaways

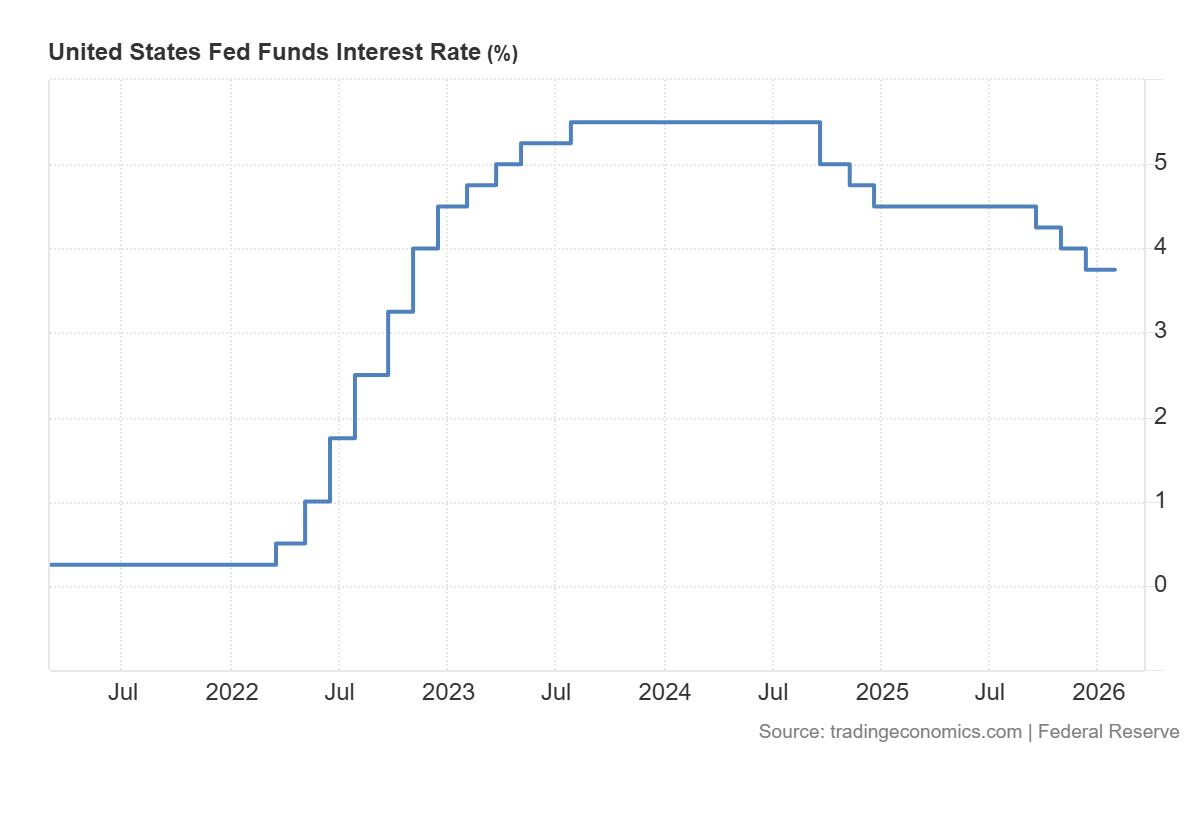

- Recent data: the US Federal Reserve kept the key interest rate at 3.75%

- Market impact: the data has a neutral-to-restraining effect on the stock market

US 500 fundamental analysis

The Fed’s decision to keep the key interest rate at 3.75%, fully in line with market expectations, did not in itself generate a strong momentum for US equities. However, Jerome Powell’s comments significantly clarify the interpretation of this decision. His statement that the current stance of monetary policy is appropriate indicates that the regulator sees no urgent need to change course. At the same time, Powell emphasised that inflation remains above the 2% target, and a significant portion of inflationary pressure is linked to tariffs rather than excess demand. This means that, despite recent improvements in macroeconomic data, the Federal Reserve does not consider conditions sufficient for a confident move towards rate cuts.

For the US 500 index, the effect is predominantly neutral to restraining. The broader market benefits from policy stability and the absence of negative surprises, but at the same time faces constraints from expectations of high interest rates. This is particularly relevant for sectors sensitive to the cost of capital, while companies with more stable cash flows and lower debt burdens appear relatively more resilient.

US Fed funds interest rate: https://tradingeconomics.com/united-states/interest-rateUS 500 technical analysis

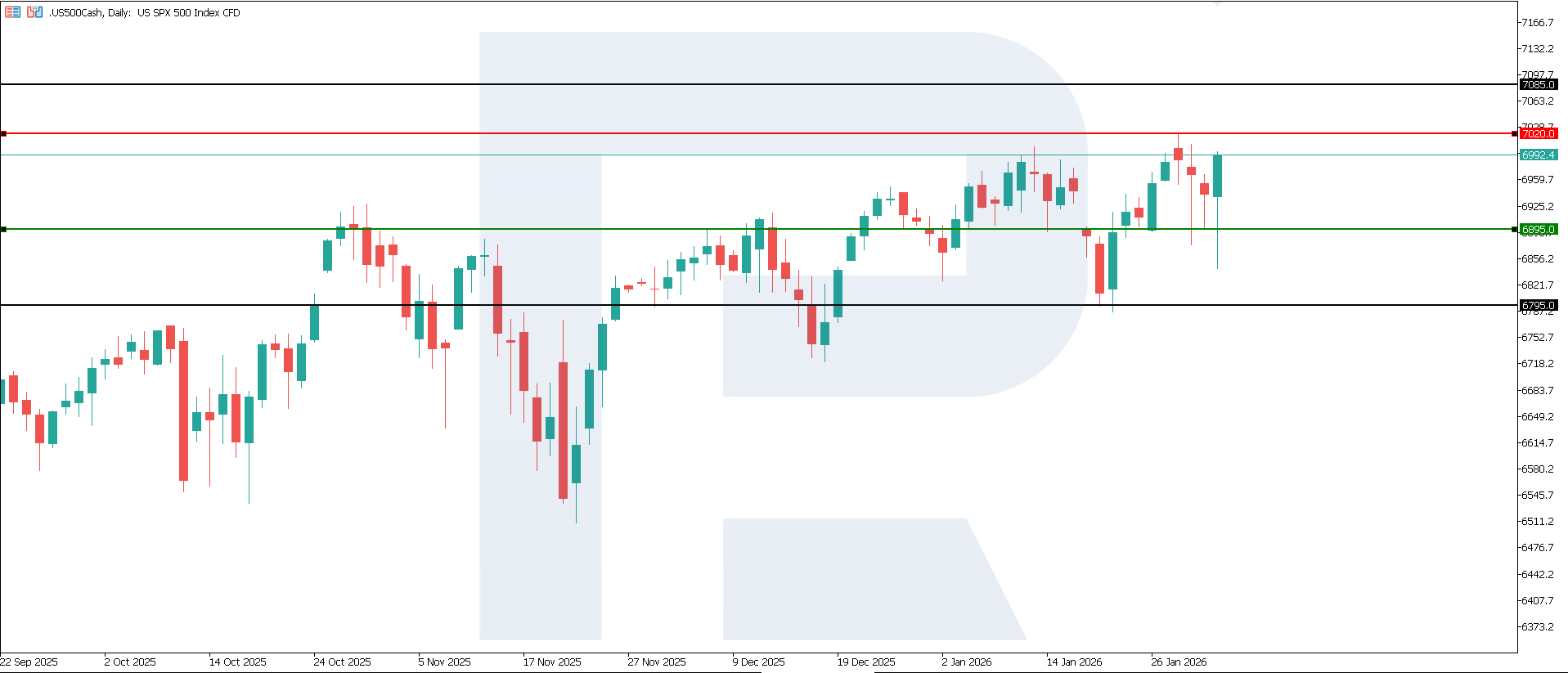

The US 500 index has formed a support level at 6,895.0 and a resistance level at 7,020.0. The index is rebounding from the support level with the potential to break above resistance. The target for a possible advance is located near 7,085.0.

The US 500 price forecast considers the following scenarios:

- Pessimistic US 500 forecast: a breakout below the 6,895.0 support level could push the index down to 6,795.0

- Optimistic US 500 forecast: a breakout above the 7,020.0 resistance level could drive the index to 7,085.0

Summary

Given Powell’s comments, the Fed’s decision confirms the scenario of maintaining tight financial conditions without immediate tightening, but also without a clear signal of an imminent rate cut. For the US equity market and the US 500 index, this implies a neutral-to-negative balance of risks in the short term and increased dependence of further dynamics on inflation data and bond market reactions. From a technical perspective, the US 500 index may rise to 7,085.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.