US Tech analysis: a decline in NVIDIA stock drags down the entire index

Following a recovery, the US Tech index resumed a downtrend, falling by 2.83% yesterday. The future US Tech forecast is negative.

US Tech forecast: key trading points

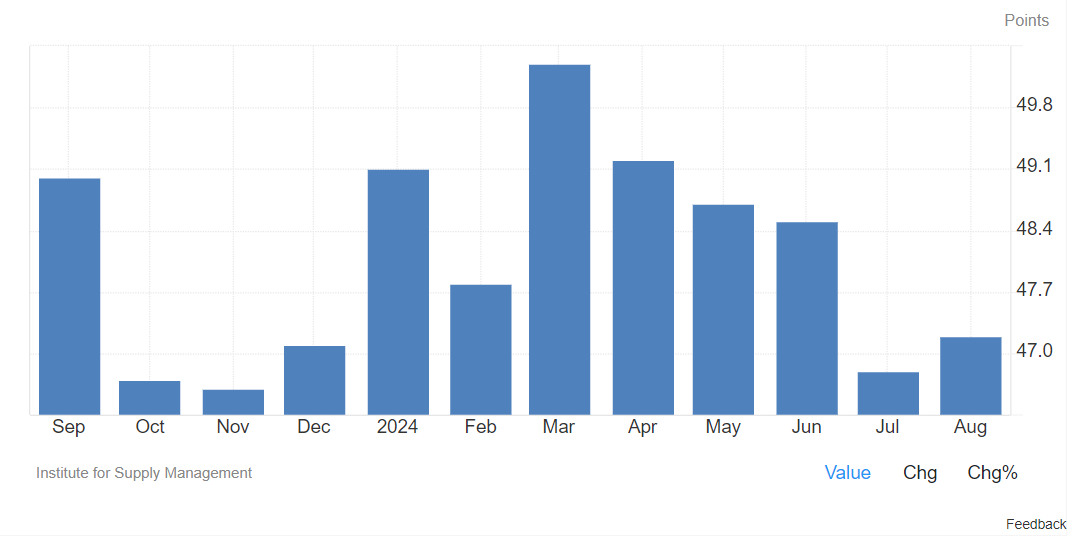

- Recent data: the US manufacturing PMI rose to 47.2 points

- Economic indicators: the services sector has the largest share of US GDP; however, a decline in the manufacturing sector may lead to an overall economic slowdown

- Market impact: the indicator is not crucial for market participants but serves as an indirect gauge of business sentiment

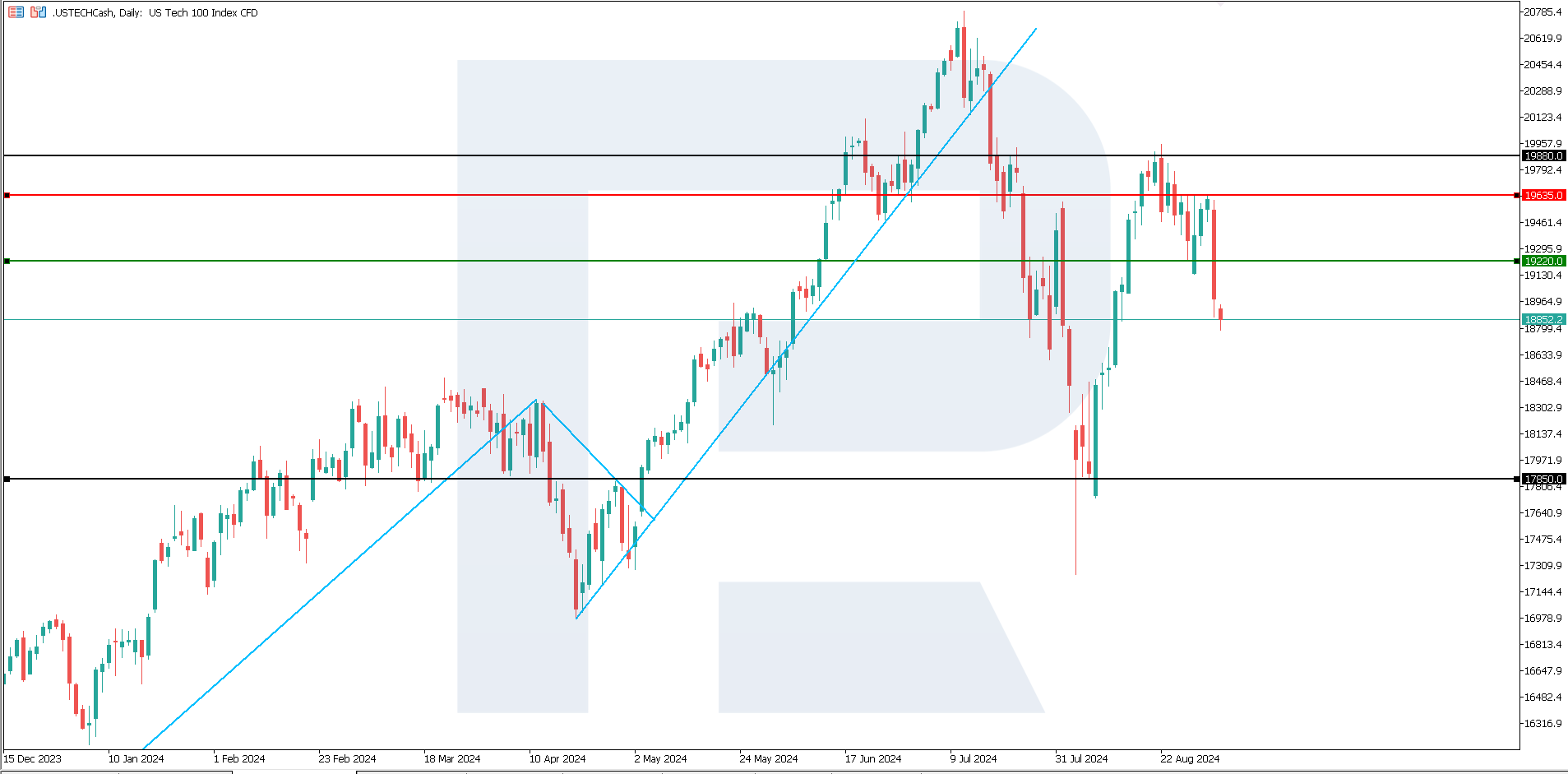

- Resistance: 19,635.0, Support: 19,220.0

- US Tech price forecast: 17,850.0

Fundamental analysis

On Tuesday, the Institute for Supply Management (ISM) reported that the manufacturing PMI rose to 47.2 in August from 46.8 in July, the lowest reading since November. The US manufacturing PMI increased last month from an eight-month low recorded in July amid some improvement in employment. However, the general trend still indicates subdued industrial activity.

Source: https://tradingeconomics.com/united-states/business-confidence

The manufacturing industry accounts for only 10% of the US economy, with jobs in this sector making up 8% of the US workforce. For this reason, weak manufacturing sector data is unlikely to be the primary cause of the decline.

A drop in the US Tech index was likely primarily driven by a fall in NVIDIA Corp stock. The sell-off of its shares was caused by the US Department of Justice sending subpoenas to NVIDIA and other companies to find evidence that the chipmaker has violated antitrust laws. This is an intensified probe into the dominant supplier of processors for artificial intelligence. As a result, the US Tech forecast for next week is negative.

US Tech technical analysis

The US Tech stock index is in a downtrend, with the decline likely to continue. The current 19,220.0 support level was breached yesterday, while a new one has yet to form. Additionally, it is worth noting that the US Tech has yet to recover from its previous all-time highs. Therefore, the US Tech price forecast is negative.

Key levels for the US Tech analysis:

- Resistance level: 19635.0 – a breakout above this level could drive the price to 19,880.0

- Support level: 19220.0 – this level has already been breached, with a target at 17,850.0

Summary

The US manufacturing PMI rose to 47.2 points last month from an eight-month low. However, the US Tech decline was primarily driven by a case against NVIDIA Corp regarding antitrust law violations. The price broke below the 19,220.0 support level, with a further decline target at 17,850.0. For this reason, the US Tech index forecast is negative.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.