US Tech forecast: the index resumes growth and is poised to hit a new all-time high

The US Tech index has entered an uptrend as part of the Santa rally. The US Tech forecast for next week is positive.

US Tech forecast: key trading points

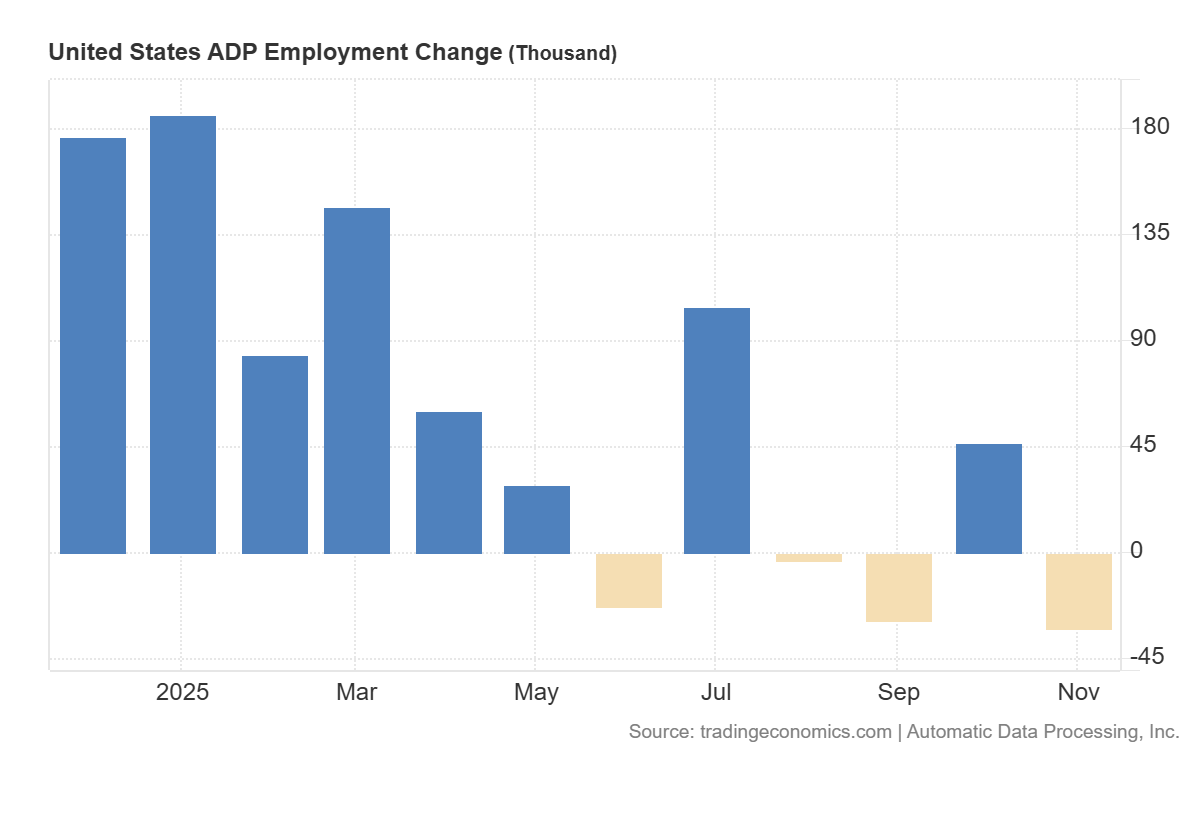

- Recent data: US ADP employment change declined by 32 thousand in November

- Market impact: the current data is generally positive for the technology sector

US Tech fundamental analysis

The ADP employment report came in significantly weaker than expected, with the private sector losing 32 thousand jobs instead of growing by 5 thousand, compared to 47 thousand added in the previous month. This is a sharp reversal and a signal that companies have become more cautious about hiring, while some industries are already implementing layoffs. For the market, this is an early warning sign: the data points to a noticeable cooling of the economy and could amplify discussions about risks of slowing growth or even a technical recession if similar dynamics appear in official payrolls.

US ADP employment change: https://tradingeconomics.com/united-states/adp-employment-changeFor the US stock market as a whole, such a report has a dual effect. On the one hand, a weak labour market puts potential pressure on corporate earnings, especially in cyclical sectors dependent on consumer spending and business investment. In this context, investors may reduce their interest in industrials, commodities, and retail stocks, and some market participants may lock in profits following the recent rallies. On the other hand, such weak labour data significantly boosts expectations of a more accommodative Federal Reserve policy.

US Tech technical analysis

For the US Tech index, the impact of the ADP report tends to lean towards a moderately positive reaction, at least initially. The technology sector is particularly sensitive to interest rates because a substantial portion of its valuation relies on future earnings. When market participants begin to price in earlier or deeper rate cuts, long-term bond yields tend to decline – a development that typically supports technology shares.

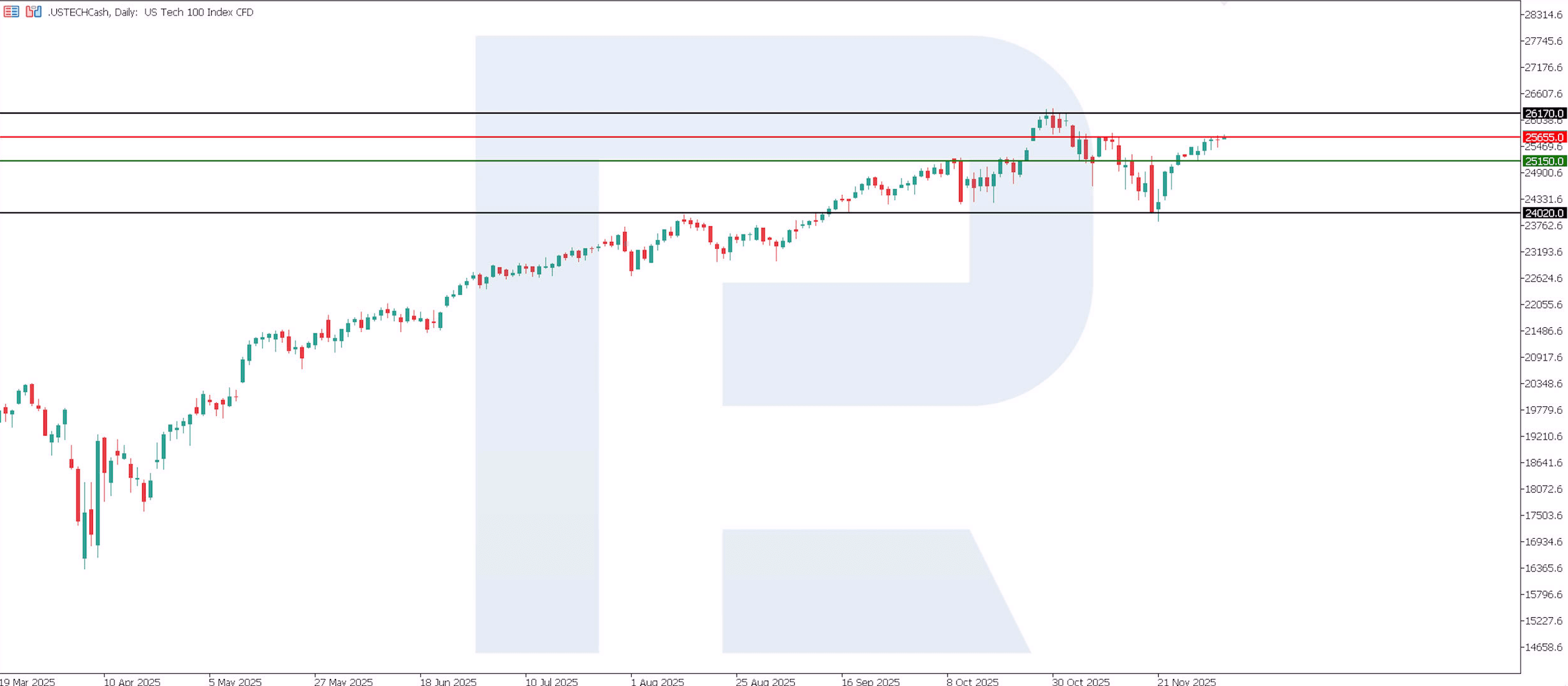

US Tech technical analysis for 5 December 2025The US Tech index has entered an uptrend, with the nearest resistance level at 25,655.0 and the support level at 25,150.0. An upside target could be the 26,170.0 level.

The US Tech price forecast outlines the following scenarios:

- Pessimistic US Tech scenario: a breakout below the 25,150.0 support level could send the index to 24,020.0

- Optimistic US Tech scenario: a breakout above the 25,655.0 resistance level could drive the index to 26,170.0

Summary

The latest ADP report creates a backdrop of heightened volatility for the US stock market and the US Tech index. For the broader market, it signals rising macroeconomic risks while simultaneously strengthening expectations of Fed easing. For the technology sector, the near-term outlook may favour growth thanks to falling bond yields and increased capital inflows into growth stocks. However, the durability of this effect will depend on whether the labour market weakness proves temporary or becomes a persistent trend. The next upside target could be the 26,170.0 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.