US Tech forecast: the index resumed growth

The US Tech index has broken out of its sideways trend and moved closer to its all-time high. The US Tech forecast for next week is positive.

US Tech forecast: key takeaways

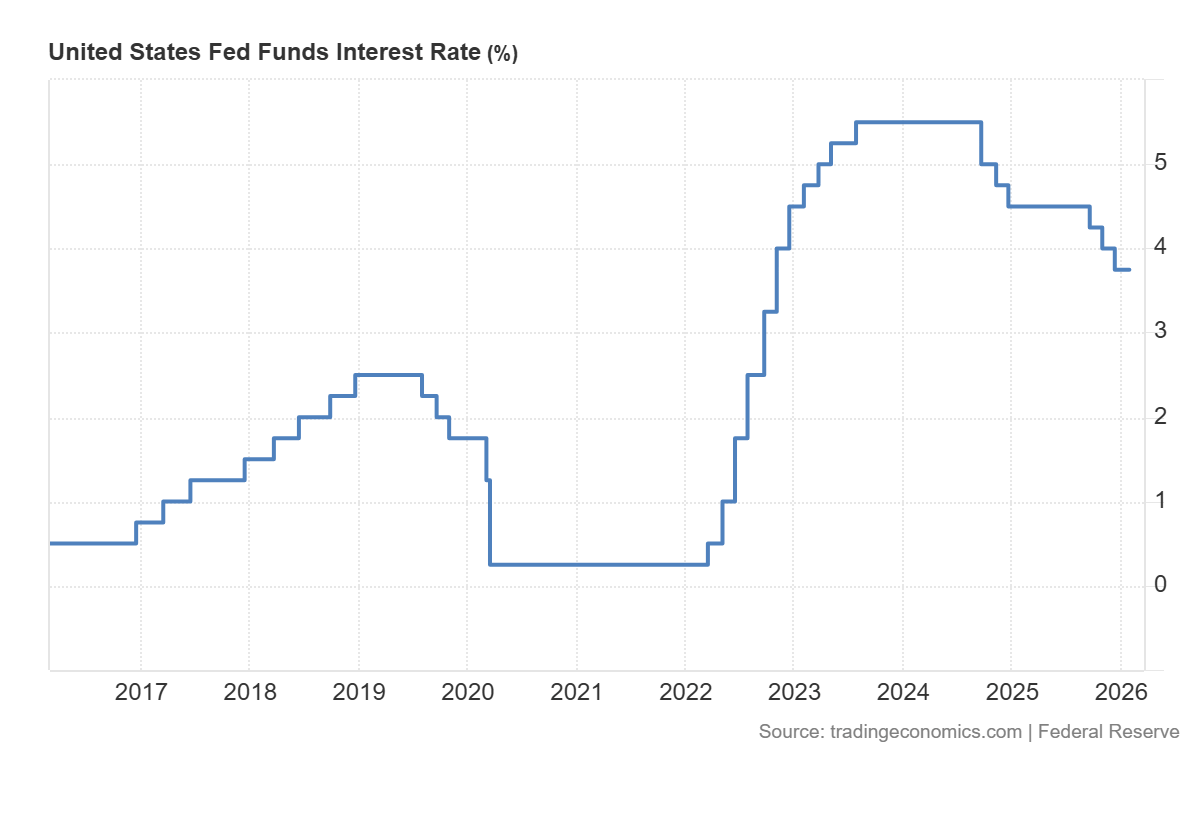

- Recent data: the US Federal Reserve kept the policy rate at 3.75%

- Market impact: the current data is moderately positive for the technology sector

US Tech fundamental analysis

The Federal Reserve’s decision to keep the rate at 3.75% was neutral for the market; however, Jerome Powell’s comments shifted the emphasis towards a more cautious, yet overall more hawkish interpretation. The statement that the current monetary policy configuration is appropriate means that the regulator sees no need to accelerate the easing of financial conditions. At the same time, Powell specifically emphasised that inflation is still above the 2% target and that a significant part of its acceleration is related to tariffs, that is, cost-side factors rather than overheated demand.

US Fed funds interest rate: https://tradingeconomics.com/united-states/interest-ratePowell’s answers to questions about a possible rate cut reinforce this picture. He reiterated that decisions will be made based on incoming data, while at the same time noting an improvement in economic statistics amid persistently elevated inflation. Such a combination typically implies that the Fed has fewer incentives to cut rates in the near term, as the economy is not showing clear signs of sharp cooling.

US Tech technical analysis

For the US Tech index (the technology sector), the impact is more pronounced, as the technology sector is more dependent on the cost of capital and the discount rate of future cash flows. Improving macroeconomic data is typically interpreted as a signal that a rate cut is not an imminent step. This increases the likelihood of a prolonged period of high rates and may weigh on the US Tech more than on the broader market, even if the overall economic backdrop appears resilient.

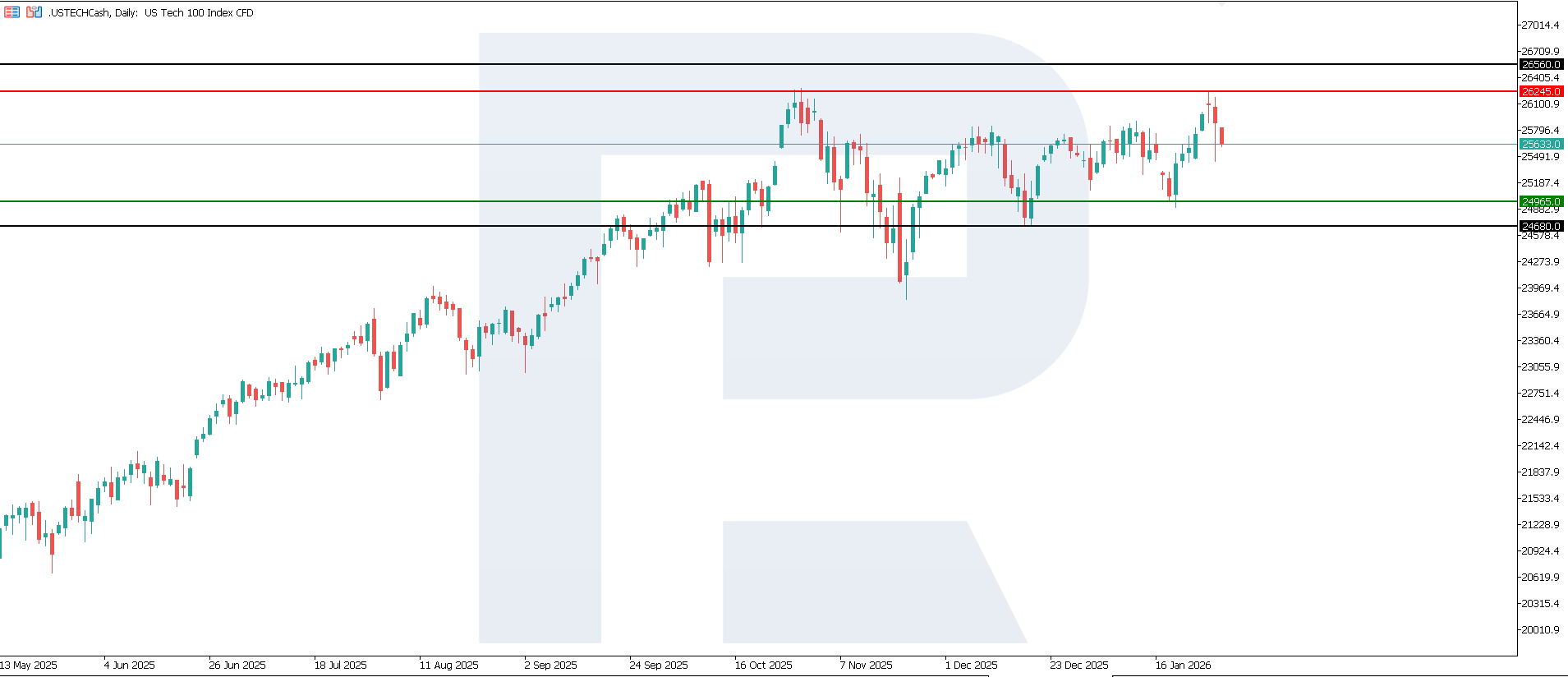

US Tech technical analysis for 30 January 2026The US Tech index resumed a sideways trend, with the nearest resistance level formed at 26,245.0 and the support level shifting to 24,965.0. A short-term correction is underway, but it is unlikely to turn into a downtrend. The upside target could be 26,560.0.

The US Tech price forecast outlines the following scenarios:

- Pessimistic US Tech scenario: a breakout below the 24,965.0 support level could send the index to 24,680.0

- Optimistic US Tech scenario: a breakout above the 26,245.0 resistance level could boost the index to 26,560.0

Summary

Given Powell’s comments, the current pause appears to be a confirmation of the Fed’s readiness to keep rates at a level it considers sufficient to control inflation. For the US stock market overall, this is a neutral-to-restrictive signal, while for the US Tech index, it is rather moderately negative, as it increases the likelihood of keeping the key rate at its current level until July of this year. The nearest upside target may be 26,560.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.