Amazon shows steady growth – a correction could present a buying opportunity

Amazon outperformed market expectations across key metrics, confirming the resilience of its growth model. After reaching a new all-time high, the stock entered a corrective phase but continues to hold upside potential.

Amazon.com, Inc. (NASDAQ: AMZN) Q3 2025 results exceeded market expectations: revenue rose to 180 billion USD (+13% y/y), while earnings per share (EPS) came in at 1.95 USD – well above analyst forecasts. The main contributors were the retail segment, AWS, and advertising. Operating profit totalled approximately 17.4 billion USD, broadly unchanged from a year earlier; however, this figure included one-off expenses of 2.5 billion USD related to the FTC Prime settlement and around 1.8 billion USD for restructuring and layoffs. Excluding these factors, operating profit and margins would have been significantly higher.

Net income was further boosted by a non-cash gain of 9.5 billion USD from the revaluation of Amazon’s stake in Anthropic. All major segments posted solid growth: both North America and International achieved double-digit revenue increases, while AWS accelerated growth to 20% and maintained strong margins, remaining the company’s primary profit driver.

Management noted that demand for AWS cloud and AI services continues to expand, while the advertising business remains the fastest growing segment. For Q4, Amazon expects revenue growth in the range of 10–13% and a further improvement in operating profit, while reaffirming a high level of investment in data centres, AI infrastructure, and logistics. Overall, the quarter demonstrated that Amazon’s operating model is becoming more resilient and profitable, despite the impact of one-off costs and temporary accounting effects.

This article provides an overview of Amazon.com, Inc., offering a fundamental analysis of Amazon’s (AMZN) financial performance and a technical analysis of Amazon.com shares, forming the basis for the AMZN stock forecast for 2026. It also examines the company’s business model, evaluates the risks of investing in Amazon.com, and presents expert forecasts for Amazon shares.

About Amazon.com, Inc.

Amazon.com, Inc. is one of the world’s largest technology companies. It was established by Jeffrey Bezos in 1994 in Seattle, US. Initially, the company specialised in selling books online but has since evolved into a multi-industry platform. Today, Amazon is engaged in e-commerce, provides cloud computing services through Amazon Web Services (AWS), manufactures electronics (such as Kindle and Echo), and develops media services, including streaming and content production.

The company held its IPO on 15 May 1997, listing its shares on the NASDAQ under the ticker AMZN.

Image of the company name Amazon.com, Inc.Amazon.com, Inc.’s main financial flows

Amazon’s revenue is based on several key segments, reflecting the company’s varied, multisectoral operations:

- Online retail: selling goods directly on behalf of the company, including books, electronics, clothing, household appliances, and more.

- Marketplace: providing the company’s platform to third-party sellers to sell their goods through its website. Amazon generates revenue from sales commissions, paid storage and delivery services and other seller support services.

- Cloud computing (Amazon Web Services): this is the world’s largest cloud service provider. The service includes server rentals, data storage, big data analytics tools, and other cloud solutions. This segment generates Amazon’s highest profits compared to all other business areas.

- Subscriptions (Amazon Prime and other services): providing access to streaming platforms (video and music), cloud storage, and other products. This category also includes revenue from subscriptions to other services, such as Kindle Unlimited and Amazon Music Unlimited.

- Advertising: actively developing its digital advertising business, including income from placing advertisements on the platform, such as ads in search results. Revenue from these and other advertising services has increased significantly in recent years.

- Offline retail stores: physical sales outlets, including Amazon Go and Amazon Fresh stores, Whole Foods Market supermarkets, and speciality book and electronics stores.

- Electronics and technology sales: producing and selling its own products, including the popular Kindle eBooks, Echo smart speakers with Alexa voice assistant, Fire TV streaming boxes, and other technology products.

- Other areas: less significant revenue streams, such as providing logistics services to third parties, acting as an intermediary in book publishing (Amazon Publishing), developing video games (Amazon Game Studios), income from the Twitch streaming platform, and other innovative projects.

These diverse revenue streams enable Amazon.com, Inc. to remain resilient to changing market conditions and expand its influence across various sectors.

Amazon.com, Inc. Q3 2024 earnings results

Amazon reported it ended Q3 2024 with gains across key financial indicators. Below is the main report data:

- Revenue: 158.9 billion USD (+11%)

- Net income: 15.3 billion USD (+54%)

- Earnings per share: 1.43 USD (+52%)

- Operating profit: 17.5 billion USD (+55%)

Revenue by segment:

- North America: 95.5 billion USD (+8%)

- Operating income (loss): 5.7 billion USD (+30%)

- International: 35.9 billion USD (+11%)

- Operating income (loss): 1.3 billion USD – in Q3 2023, the company posted a loss of 95 million USD

- Amazon Web Services (AWS): 27.4 billion USD (+19%)

- Operating income (loss): 10.4 billion USD (+49%)

All key financial metrics showed growth in Q3 2024. The international segment saw increased sales, but costs also rose concurrently. As a result, it remained the most vulnerable and could be the first to incur losses in the event of even minor economic disruptions.

The North American segment contributed the most to the company’s total revenue but also incurred the highest costs.

AWS remained Amazon’s most promising and profitable division, demonstrating sustained growth and strong profitability.

For Q4 2024, Amazon forecasts revenue between 181.0 and 188.0 billion USD, representing a 7-11% increase compared to the corresponding period in 2023. Operating profit is expected to range between 16.0 and 20.0 billion USD, up from 13.0 billion USD a year earlier.

Amazon.com, Inc. Q4 2024 earnings results

Amazon reported ending Q4 2024 with growth in key financial metrics once again. The key figures from the report are as follows:

- Revenue: 187.8 billion USD (+10%)

- Net income: 20.0 billion USD (+88%)

- Earnings per share: 1.86 USD (+86%)

- Operating profit: 21.2 billion USD (+60%)

Revenue by segment:

- North America: 115.5 billion USD (+9%)

- Operating income (loss): 9.6 billion USD (+43%)

- International: 43.4 billion USD (+8%)

- Operating income (loss): 1.3 billion USD - In Q4 2023, the company posted a loss of 419 million USD

- Amazon Web Services (AWS): 28.8 billion USD (+19%)

- Operating income (loss): 10.6 billion USD (+48%)

In its commentary on the Q4 2024 report, Amazon’s management provided forecasts for 2025, focusing on revenue, operating profit, and capital expenditures. For Q1 2025, revenue is expected to range between 151.0 and 155.5 billion USD, below the consensus forecast of 158.6 billion USD. Operating profit for this period is projected at 16.0 billion USD, which also falls short of analysts’ expectations.

The company also announced a significant increase in capital expenditures, which could reach 105.0 billion USD in 2025. This marks a notable rise compared to 77.0 billion USD in 2024 and more than double the 48.0 billion USD spent in 2023. These investments will primarily focus on infrastructure, including the expansion of the AWS cloud business and the development of AI solutions.

AWS is anticipated to remain Amazon’s key growth driver in 2025 due to a trend of companies migrating to cloud infrastructure, the end of the cost optimisation phase, and increasing demand for AI solutions. The company has described artificial intelligence as a once-in-a-lifetime opportunity.

The data indicates that Amazon is heavily investing in developing AWS and AI, with substantial investment in infrastructure. However, the weaker-than-expected revenue and operating income forecast for Q1 2025 has disappointed investors, negatively impacting the share price.

Amazon.com, Inc. Q1 2025 earnings results

On 1 May, Amazon.com released its report for Q1 2025, ending 31 March. Below are the key indicators compared to the same period in 2024:

- Revenue: 155.66 billion USD (+9%)

- Net income: 17.12 billion USD (+64%)

- Earnings per share: 1.59 USD (+62%)

- Operating profit: 18.40 billion USD (+22%)

Revenue by segment:

- North America: 92.89 billion USD (+8%)

- Operating income: 5.84 billion USD (+17%)

- International: 33.51 billion USD (+5%)

- Operating income: 1.01 billion USD (+12%)

- Amazon Web Services (AWS): 29.26 billion USD (+17%)

- Operating income: 11.54 billion USD (+22%)

Amazon.com, Inc.’s Q1 2025 earnings report demonstrated solid results, which may attract investors seeking companies with sustainable growth and operational efficiency.

Net sales rose 9% year-on-year despite an adverse currency exchange effect of 1.4 billion USD. This growth was driven by an 8% rise in North American sales and a 5% increase internationally, confirming Amazon’s ability to strengthen its global market position amid economic uncertainty.

A major achievement for the company was the 64% increase in profit and 22% rise in operating profit, reflecting cost optimisation and improved logistics.

Amazon Web Services (AWS), the company’s key profit driver, recorded a 17% increase in sales, reaching an annualised revenue of 117 billion USD. However, it slightly underperformed expectations due to reduced corporate spending amid concerns about tariffs and a potential recession. By comparison, Microsoft Azure, within the Intelligent Cloud segment, grew by 21%, while Google Cloud recorded an even more impressive 28% increase. While AWS maintained its market share leadership (29% in Q1 2025 compared to Microsoft’s 22% and Google’s 10%), it lagged behind its competitors in growth rates, likely due to a higher comparison base and a temporary slowdown in corporate investment in cloud technologies.

Amazon’s online advertising segment grew by 19%, generating 13.92 billion USD, further solidifying its position as the company’s third-largest revenue stream.

However, not everything was positive. The company recorded a 1 billion USD write-down due to product returns and inventory adjustments linked to tariffs. This included 800 million USD in losses from North American retail and 200 million USD in international markets.

AMZN shares fell following the earnings release. The decline was attributed to slower AWS growth and a conservative Q2 2025 forecast, with operating profit expected in the range between 13.0 and 17.5 billion USD, below the consensus estimate of 17.8 billion USD. Management’s caution was linked to tariff policies, particularly the potential 145% duties on Chinese goods, which could affect half of Amazon’s product range. Nevertheless, the forecast appears understated, which could allow the company to exceed expectations if consumer demand remains steady and AWS growth recovers.

While risks remain, including tariff pressures and increased competition in the cloud segment, where Microsoft and Google are accelerating growth. However, Amazon’s competitive advantages in logistics, customer loyalty, and innovation remain significant.

Amazon.com, Inc. Q2 2025 earnings results

On 31 July, Amazon.com released its report for Q2 2025, which ended on 30 June. Below are the key metrics compared with the same period in 2024:

- Revenue: 167.70 billion USD (+13%)

- Net income: 18.16 billion USD (+34%)

- Earnings per share: 1.68 USD (+33%)

- Operating profit: 19.17 billion USD (+30%)

Revenue by segment:

- North America: 100.07 billion USD (+11%)

- Operating income: 7.51 billion USD (+48%)

- International: 36.76 billion USD (+16%)

- Operating income: 1.49 billion USD (+345%)

- Amazon Web Services (AWS): 30.87 billion USD (+17%)

- Operating income: 10.16 billion USD (+9%)

Amazon ended Q2 2025 ahead of expectations on both revenue and profit while maintaining high operational efficiency. Revenue rose by 13% to 167.7 billion USD, operating profit reached 19.2 billion USD, and net income came in at 18.2 billion USD, or 1.68 USD per share. The segments showed divergent dynamics: AWS added 17.5%, North America grew by 11%, and the international business grew by 16%. Advertising was a key growth driver, with revenue of 15.7 billion USD and an increase of 23%, supporting monetisation across platforms from the marketplace to Prime Video.

In H2, the company expected Q3 2025 revenue in the range of 174–179.5 billion USD and operating profit of 15.5–20.5 billion USD – guidance that investors viewed as cautious given high expectations for AI and cloud growth.

For the second consecutive quarter, AWS’s growth rate lagged behind that of its competitors. In Q2, Amazon’s AWS revenue grew by 17% year-on-year, but this was noticeably slower than Microsoft Azure’s (+39%) and Google Cloud’s (+32%). The main reason was that AI-related workloads were distributed unevenly: Azure’s growth was driven by integrations with OpenAI and a surge in AI-related demand, while Google Cloud benefited from large enterprise contracts and broader AI data usage.

AWS primarily serves mature corporate clients with traditional cloud services, resulting in steady but less striking growth compared to rivals offering a broader range of new AI use cases.

In summary, the slower growth rate does not indicate that AWS is losing ground. Amazon currently continues to build AI infrastructure and gradually increase capacity. Key factors to watch in the coming quarters include an acceleration in AWS revenue, successful monetisation of new AI tools such as Bedrock and Agent, and a recovery in margins.

Amazon.com, Inc. Q3 2025 earnings results

Amazon.com reported its Q3 2025 earnings results on 30 October, covering the period ended 30 September. Below are the key figures compared with the same quarter in 2024:

- Revenue: 180.17 billion USD (+13%)

- Net income: 21.19 billion USD (+38%)

- Earnings per share: 1.95 USD (+37%)

- Operating profit: 17.42 billion USD (0%)

Revenue by segment:

- North America: 106.27 billion USD (+11%)

- Operating income: 4.79 billion USD (–15%)

- International: 40.90 billion USD (+14%)

- Operating income: 1.20 billion USD (–8%)

- Amazon Web Services (AWS): 33.01 billion USD (+20%)

- Operating income: 11.43 billion USD (+9%)

Amazon’s Q3 2025 report came in ahead of analyst expectations. Revenue rose by 13% to 180.2 billion USD, surpassing the market consensus of around 178 billion USD, while earnings per share reached 1.95 USD versus the forecast of roughly 1.56 USD. The company exceeded expectations on both the top and bottom lines. Excluding one-off expenses, the results would have been even stronger. Operating profit totalled 17.4 billion USD; however, this figure included 4.3 billion USD in one-off charges (2.5 billion USD related to FTC litigation and 1.8 billion USD linked to layoffs). Without these items, operating profit would have been approximately 21.7 billion USD, with an operating margin of 12% compared with the reported 9.7%.

Net income increased to 21.2 billion USD (+39% y/y), although a significant portion came from a one-off gain of 9.5 billion USD from the revaluation of Amazon’s stake in Anthropic, unrelated to its core operations.

Performance across segments was also strong: North America revenue grew 11%, international operations expanded 14%, and AWS advanced 20% – its fastest growth rate in the past 11 quarters. AWS maintained a healthy margin of around 35%, while Amazon’s advertising business grew by more than 20%, becoming an increasingly important source of profitability.

Management highlighted that the company’s key pillars – retail, advertising and cloud – continue to see resilient demand despite a softer consumer backdrop. They also pointed out the acceleration in AWS growth, driven by demand for AI-related services and continued enterprise cloud migration.

Guidance for Q4 2025 was similarly upbeat: Amazon expects revenue of 206–213 billion USD (+10–13% y/y) and operating profit of 21–26 billion USD. The company also noted that capital expenditure in 2025 will total around 125 billion USD and is expected to rise further in 2026, primarily due to investments in AWS infrastructure, Trainium and Inferentia AI chips, robotics and logistics. Free cash flow declined to 14.8 billion USD owing to increased investment levels.

Fundamental Analysis of Amazon.com, Inc.

Fundamental analysis of Amazon (AMZN) based on Q3 2026 results

- #. Liquidity and debt: at the end of Q3 2025, Amazon held 66.9 billion USD in cash and equivalents and an additional 27.3 billion USD in marketable securities, giving a total liquidity position of 94.2 billion USD. Current assets and current liabilities are broadly balanced (196.9 billion USD versus 195.2 billion USD), indicating that the company maintains a healthy working-capital position and does not require large cash buffers, as it recycles capital through the business at a high rate.

Long-term debt stands at around 50.7 billion USD, while short-term borrowings are minimal. In effect, Amazon is in a net cash position, as its liquidity significantly exceeds its debt. Over the past 12 months, operating profit reached approximately 76.2 billion USD, compared with just 1.6 billion USD in interest expense – meaning the company covers all debt-related costs with a substantial margin of safety.

- Cash flows and free cash flow: over the 12 months to Q3 2025, Amazon’s operating cash flow rose by 16% to 130.7 billion USD — an exceptionally strong result, particularly for a company with such a large retail footprint. Capital expenditure over the same period amounted to 115.9 billion USD, with 34.2 billion USD spent in Q3 alone. The bulk of these investments was directed towards AWS data centres, AI infrastructure, logistics and energy projects.

Because of this elevated investment cycle, free cash flow declined to 14.8 billion USD from 47.7 billion USD a year earlier. The company remains cash-generative and reinvests almost all its operating cash flow into growth. Amazon does not pay dividends and conducts only limited share buybacks, reflecting its strategic priority of expansion. Even at this investment pace, free cash flow remains positive, and should capital intensity moderate, FCF is likely to rebound sharply.

- Quality of earnings and business structure: the quarterly results were also strong: revenue grew 13%, AWS expanded 20%, North America increased 11% and international operations rose 14%. Service-based revenue (AWS, advertising, subscriptions, and other services) reached 106.1 billion USD and now exceeds product revenue (74.1 billion USD), supporting overall margin resilience.

Amazon’s business structure is becoming increasingly balanced. AWS accounts for 18% of total revenue but delivers roughly 65% of operating profit. Advertising revenue is growing at around 20% annually, and retail segments, following logistics optimisation, have returned to consistent profitability.

Conclusion: from a fundamental perspective, Amazon remains one of the most financially resilient global companies. It has a substantial liquidity buffer, a net cash position, strong operating cash generation and well-diversified revenue streams across AWS, advertising and subscriptions. One-off factors somewhat distort the reported quarterly numbers, but excluding these, underlying operating profit and margins continue to improve.

The key risk for Amazon does not lie in financial stability but in the scale of its investment cycle. The company is deploying record amounts into AI infrastructure and logistics, temporarily depressing free cash flow and increasing dependence on the performance of AWS and AI-related initiatives. Even so, the business remains robust and profitable, and the probability of financial distress is extremely low.

Analysis of Amazon.com, Inc.’s key valuation multiples

Below are the main valuation multiples for Amazon.com, Inc. based on the Q3 2026 financial results, calculated at a share price of 233 USD.

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | Price paid for 1 USD of earnings over the past 12 months | 32.9 | ⬤ Trading at a premium to both the market and its own historical average – not cheap, but the rise in profit and margins partly justifies it. The valuation cushion is limited. |

| P/S (TTM) | Price paid for 1 USD of annual revenue | 3.6 | ⬤ High for a retail + AWS mix – the market is paying for improved margins and the AI growth story, but the stock is no longer attractively valued. |

| EV/Sales (TTM) | Enterprise value to sales, accounting for debt | 3.5 | ⬤ Similar to P/S since Amazon holds net cash. Valuation remains above the average for large online retailers. |

| P/FCF (TTM) | Price paid for 1 USD of free cash flow | 168 | ⬤ The company is currently generating little free cash flow, as significant spending is directed towards AI infrastructure and logistics. |

| FCF Yield (TTM) | Free cash flow yield to shareholders | 0.6% | ⬤ Yield is almost negligible. AMZN shares are essentially a pure play on future free cash flow. |

| EV/EBITDA (TTM) | Enterprise value to operating profit before depreciation and amortisation | 17.0 | ⬤ High for a company of this scale – especially considering that capital expenditure is rising aggressively. |

| EV/EBIT (TTM) | Enterprise value to operating profit | 32.1 | ⬤ The market is paying over 30 times annual operating earnings – a clear premium for Amazon’s AI infrastructure investments. |

| P/B | Price to book value | 6.7 | ⬤ For digital companies, P/B is less relevant, yet the high level indicates that Amazon’s shares are already trading at a substantial premium. |

| Net Debt/EBITDA | Debt burden relative to EBITDA | –0.3 | ⬤ Strong liquidity position – the company holds more cash than debt. |

| Interest Coverage (TTM) | Ability to cover interest expenses with operating profit | 46 | ⬤ Interest costs are minimal relative to profit, reflecting very low financial risk. |

Valuation analysis of Amazon.com, Inc. – conclusion

At a share price of 233 USD, Amazon’s stock trades at a premium, with its core valuation multiples now leaning towards the expensive side. This valuation suggests that the market is pricing in continued growth in AWS, advertising, and AI segments, as well as a recovery in free cash flow following peak investment levels.

Amazon remains a strong and reliable company with solid long-term potential, but with little room for further re-rating at current levels, it can no longer be considered undervalued.

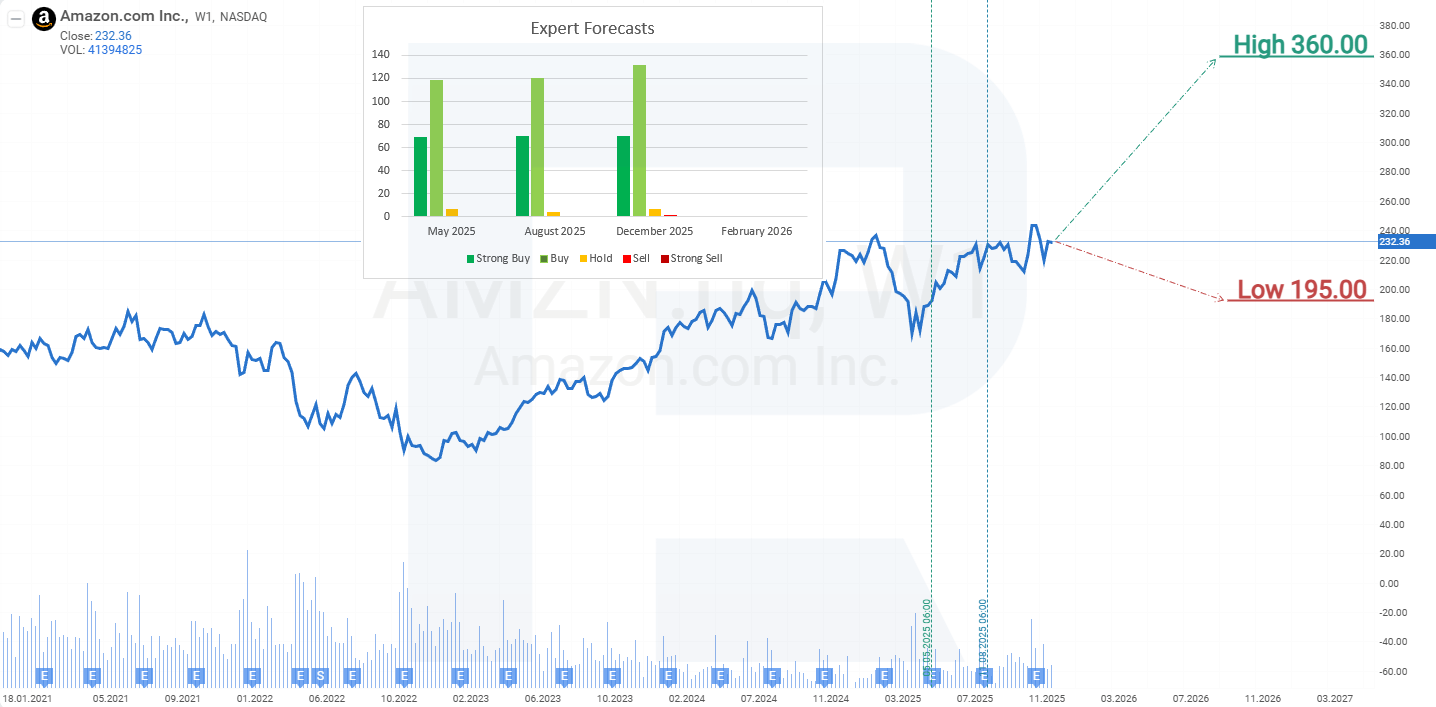

Expert forecasts for Amazon.com shares for 2026

- Barchart: 49 out of 57 analysts rated Amazon shares as a Strong Buy, 6 as a Moderate Buy, and 2 as Hold. The upper-end forecast is at 360 USD, while the lower-end forecast is at 230 USD.

- MarketBeat: 57 out of 61 analysts assigned the stock a Buy rating, 3 recommended Hold, and 1 advised Sell. The upper-end forecast is at 360 USD, with the lower bound at 250 USD.

- TipRanks: 43 out of 44 analysts rated the shares as Buy and 1 as Hold. The top-end forecast is at 340 USD, while the lower-end forecast is at 250 USD.

- Stock Analysis: 21 out of 47 experts rated Amazon shares as a Strong Buy, 25 as Buy, and 1 as Hold. The upper-end forecast is at 335 USD, with the lower-end forecast at 195 USD.

Amazon.com, Inc. stock price forecast for 2026

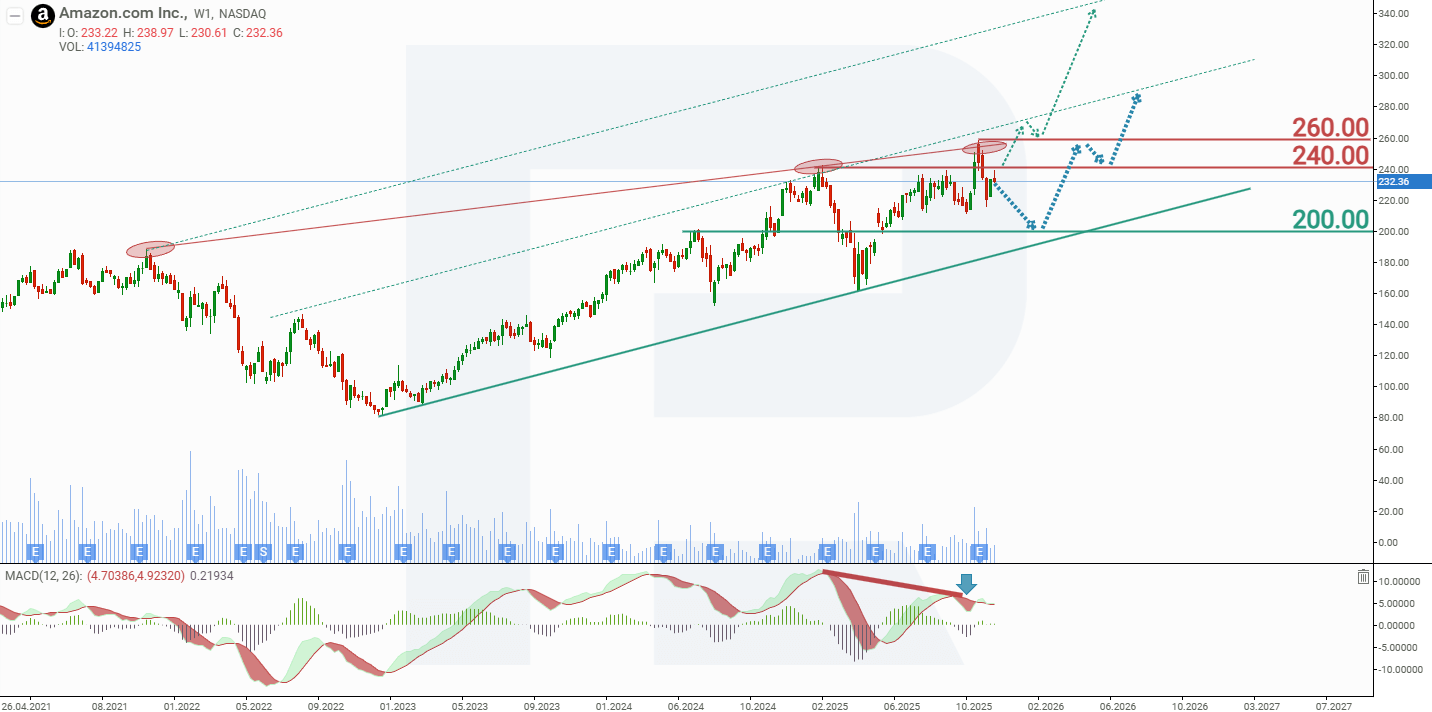

On the weekly chart, Amazon.com (AMZN) shares continue to trade within an upward-trending channel. Following the release of the Q3 2025 report, the stock reached a new all-time high near 260 USD before entering a corrective phase. A divergence has also formed on the chart, reinforcing the signal of a potential price correction. Based on the current performance of Amazon.com’s share price, the possible scenarios for 2026 are as follows:

The base-case forecast for AMZN stock assumes a continuation of the corrective decline, during which the price could fall towards support at 200 USD. A rebound from this level would indicate the completion of the correction and a potential resumption of growth towards the channel’s upper boundary near 300 USD.

The alternative forecast for AMZN shares envisions a more optimistic investor sentiment. If the price breaks through resistance at 240 USD, the rally could accelerate, leading to a breakout above the upper boundary of the channel and a further advance towards the next resistance level around 340 USD.

Amazon.com stock analysis and forecast for 2026Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.