Microsoft – stock forecast for 2026 amid strong results and weak margin outlook

Microsoft's Q2 2026 report showed a significant revenue increase to 81.3 billion USD, but the margin and capital expenditure forecast raised concerns among investors, leading to a decline in shares.

Microsoft Corporation (NASDAQ: MSFT) Q2 2026 report exceeded expectations, with revenue reaching 81.3 billion USD, a 17% increase compared to the same period last year, and EPS of 4.14 USD, also surpassing analysts’ forecasts. The growth was driven by strong demand for cloud services and AI-related products, particularly Azure, whose revenue increased by 37% in constant currency.

Microsoft’s Q3 2026 financial forecast, with revenue expected in the range of 80.65 to 81.75 billion USD, was almost in line with market expectations of around 81.20 billion USD. However, the investor reaction was negative: the operating margin target of 45.1% was slightly below the consensus of 45.5%, and continued high capital expenditures on AI infrastructure, without a noticeable acceleration in profit growth, further fuelled market doubts about the short-term returns on these investments.

This article provides an overview of Microsoft Corporation and its business. It includes a fundamental analysis of Microsoft’s reports and a technical analysis of MSFT shares, which form the basis for the Microsoft stock forecast for 2026.

About Microsoft Corporation

Microsoft Corporation is one of the world’s largest technology companies, specialising in software development, computer hardware, cloud services, and other technologies. The company was founded on 4 April 1975 by Bill Gates and Paul Allen. Microsoft is renowned for its flagship products, including the Windows operating system, the Microsoft Office suite, the Bing search engine, the Azure cloud platform, Xbox gaming consoles, and various other innovations. It is actively expanding its initiatives in artificial intelligence, corporate solutions, and software development. Microsoft’s initial public offering (IPO) occurred on 13 March 1986, when its shares were listed on the NASDAQ stock exchange under the MSFT ticker. Today, Microsoft holds a leading position in the global technology industry.

Images of the Microsoft Corporation nameMicrosoft Corporation’s key revenue streams

Microsoft’s revenue comes from three core business segments – Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Each of these is described below:

- Productivity and Business Processes: products and services designed to enhance productivity and business processes. This segment includes the following products:

Microsoft Office (Office 365 and Microsoft 365) – software suites aimed at improving productivity and optimising business processes.

LinkedIn – a professional networking platform.

Dynamics 365 – cloud-based and on-premises business management solutions, including ERP (Enterprise Resource Planning) and CRM (Customer Relationship Management).

The primary clients of this segment include corporate users, small businesses, and individuals.

- Intelligent Cloud: cloud-based platforms and infrastructure for developing corporate solutions, including:

Microsoft Azure – one of the world’s largest cloud-based platforms, providing data storage, artificial intelligence, analytics, and app development services.

Server products and licences – Windows Server, SQL Server, Visual Studio, and System Center.

Support and consulting services – technical support, training, and customisation of cloud and server solutions.

This segment focuses on companies developing complex systems and apps based on cloud computing.

- More Personal Computing: products and services aimed at individual users and personal devices, including:

Windows – an operating system that forms the basis for managing computer hardware and software resources.

Devices – the Surface line-up (laptops, tablets, hybrid devices) and accessories.

Gaming business – Xbox consoles, Xbox Game Pass subscriptions, sales of games and accessories, and revenues from cloud gaming.

Advertising – revenues from the Bing search engine and advertising on other Microsoft platforms.

This segment is targeted at end users and original equipment manufacturers (OEMs).

Microsoft Corporation Q1 2025 financial results

Microsoft released its Q1 fiscal 2025 report on 30 October 2024. Below are the key figures:

- Revenue: 65.6 billion USD (+16%)

- Net income: 24.7 billion USD (+10%)

- Earnings per share: 3.3 USD (+10%)

- Operating profit: 30.6 billion USD (+13%)

Revenue by segment:

- Productivity and Business Processes: 28.3 billion USD (+12%)

- Intelligent Cloud: 24.1 billion USD (+20%)

- More Personal Computing: 13.2 billion USD (+16%)

Microsoft’s management expressed a positive outlook on the Q1 fiscal 2025 results. Chairman and CEO Satya Nadella highlighted the company’s focus on AI transformation and its impact on business operations and workflows. Overall, AI revenue is on track to exceed 10.0 billion USD in annual revenue next quarter, marking the fastest growth in Microsoft’s history. He also noted that the company continues to expand its capabilities and attract new clients, enabling them to leverage AI platforms and tools for business development.

Looking ahead to Q2 fiscal 2025, Microsoft projected the trends observed in the previous quarter to continue. Robust growth was expected from commercial clients driven by long-term contracts, alongside a projected increase in capital expenditure on AI.

Microsoft Corporation Q2 2025 financial results

Microsoft released its Q2 2025 financial results on 29 January 2025. The key figures are as follows:

- Revenue: 69.6 billion USD (+12%)

- Net income: 24.1 billion USD (+10%)

- Earnings per share: 3.2 USD (+10%)

- Operating profit: 31.7 billion USD (+17%)

Revenue by segment:

- Productivity and Business Processes: 29.3 billion USD (+14%)

- Intelligent Cloud: 25.5 billion USD (+19%)

- More Personal Computing: 14.6 billion USD (unchanged)

Investors were particularly interested in Microsoft’s response to DeepSeek’s rapid rise. In his remarks, CEO Satya Nadella addressed the impact of DeepSeek’s recent AI achievements. He stated that while its developments are noteworthy, Microsoft remains committed to developing comprehensive AI solutions that integrate with its existing cloud and enterprise services seamlessly. He highlighted the company’s extensive infrastructure and ecosystem, which enable it to meet the growing demand for AI applications while ensuring scalability and reliability for clients worldwide.

CFO Amy Hood provided further details on Microsoft’s financial strategies amid the evolving AI landscape. She explained that the company’s capital expenditure was strategically justified and directed towards AI-driven data centres to support model training and the global deployment of cloud-based AI applications. Hood acknowledged investor concerns over increasing AI-related expenses but reassured them that stringent cost control and a focus on efficiency would enable Microsoft to expand its operating margin despite higher capital investment in this segment.

Overall, Microsoft’s leadership reaffirmed confidence in its AI strategy, stressing that its comprehensive approach and significant infrastructure investments position the company well to capitalise on the growing demand for AI services, even as competition intensifies.

Investors’ reaction to the earnings report was negative, driven by concerns that Azure’s projected growth fell short of expectations and by a sharp rise in capital expenditure.

Microsoft Corporation Q3 FY 2025 financial results

On 30 April 2025, Microsoft released its Q3 fiscal 2025 report, which ended on 31 March. Below are its highlights compared to the corresponding period in fiscal 2024:

- Revenue: 70.1 billion USD (+13%)

- Net income: 25.8 billion USD (+18%)

- Earnings per share: 3.46 USD (+18%)

- Operating profit: 32.0 billion USD (+16%)

Revenue by segment:

- Productivity and Business Processes: 29.9 billion USD (+10%)

- Intelligent Cloud: 26.8 billion USD (+21%)

- More Personal Computing: 13.4 billion USD (+6%)

Microsoft’s Q3 fiscal 2025 report reaffirmed its position as one of the leaders in cloud technologies and AI. The results exceeded market expectations and increased investor interest. The main driver of success was the Azure cloud business, which achieved a 35% year-on-year increase in revenue. Notably, AI services accounted for 16 percentage points of this growth, underscoring the rapid adoption and commercialisation of artificial intelligence within Microsoft’s products.

CEO Satya Nadella stated that the AI business is on track to reach an annualised turnover of 10 billion USD as early as the next quarter, making it the fastest-growing business in the company’s history. Microsoft 365 Copilot, now adopted by approximately 70% of Fortune 500 companies, saw particularly strong momentum. This underscored not only Microsoft’s technological leadership but also its ability to monetise innovation effectively.

The 16% increase in total revenue and 18% rise in profit fuelled a more than 10% surge in Microsoft’s share price following the earnings release, marking one of the strongest post-earnings reactions in the past decade. Investment banks also responded positively: Bank of America and Mizuho raised their price targets to a range of 485-515 USD, highlighting the robust growth prospects and notable potential in generative AI.

For the next quarter, Microsoft expects Azure revenue to rise by 31-32% in constant currency, with AI contributing significantly to this growth. CFO Amy Hood emphasised that growth is expected to accelerate further in the second half of the financial year, driven by increased investments in AI infrastructure.

Overall, Microsoft demonstrated a rare combination of maturity and innovation. The company is successfully scaling its AI solutions while continuing to strengthen its core businesses. For investors, this represents an opportunity to participate in long-term growth with a relatively low level of risk, especially amid the global shift towards digital and intelligent solutions.

Nonetheless, there are risks to consider. Firstly, Microsoft’s current market valuation remains elevated, with a forward P/E (price-to-earnings) ratio of approximately 33, which is above the sector average for technology companies. Over the past twelve months, free cash flow (FCF) exceeded 75 billion USD, underscoring financial resilience. However, with a current capitalisation of around 3.1 trillion USD, this corresponds to a free cash flow yield below 2.5%, indicating a premium valuation. Moreover, competitive pressures in the AI segment, including from Alphabet (NASDAQ: GOOG) and Amazon (NASDAQ: AMZN), as well as potential antitrust risks in the US and EU, could introduce further volatility.

Nevertheless, Microsoft’s high margins, Azure’s growth trajectory, and the scaling of AI-driven products position the company as one of the most balanced players in the market. For long-term investors willing to accept a premium valuation in exchange for strong visibility and leadership in key technology trends, Microsoft shares remain highly attractive.

Microsoft Corporation Q4 FY 2025 financial results

On 30 July 2025, Microsoft published its earnings report for Q4 of FY 2025, which ended on 30 June. The key figures are outlined below, compared to the same period in the 2024 financial year:

- Revenue: 76.4 billion USD (+18%)

- Net income: 27.3 billion USD (+24%)

- Earnings per share: 3.65 USD (+24%)

- Operating profit: 34.3 billion USD (+23%)

Revenue by segment:

- Productivity and Business Processes: 33.1 billion USD (+16%)

- Intelligent Cloud: 29.9 billion USD (+26%)

- More Personal Computing: 13.5 billion USD (+9%)

In Q4 2025, Microsoft returned 9.4 billion USD to shareholders through dividends and share repurchases.

On a full-year basis, revenue reached 281.7 billion USD (+15%), operating profit totalled 128.5 billion USD (+17%), net income was 101.8 billion USD (+16%), and EPS stood at 13.64 USD (+16%).

The forecast for Q1 2026 anticipated strong growth in revenue and profit driven by Azure, Copilot, and enterprise AI solutions. It was projected that capital expenditure could reach a record 30 billion USD, required for expanding AI infrastructure across the US and Europe. Over the longer term, Microsoft envisaged a shift in revenue composition towards high-margin AI software and enterprise solutions. The forecast also projected growth in Microsoft 365 subscriptions, LinkedIn’s user base, and advertising revenue, fuelled by AI integration. Synergy with GPT models remained a key strategic asset.

Microsoft’s management emphasised the continued expansion of its cloud business and the strengthening of its AI position. Satya Nadella stated that cloud technologies and AI are the key drivers of digital transformation, with Azure becoming the platform for the next phase of business development, surpassing 75 billion USD in annual revenue (+34%). The active adoption of Copilot and OpenAI models is strengthening customer retention and increasing average spend.

Chief Financial Officer Amy Hood highlighted a 37% increase in commercial bookings and a rise in long-term contracts. High capital investments in AI infrastructure will continue, exerting pressure on margins but laying the groundwork for future growth.

Microsoft Corporation Q1 FY 2026 financial results

On 29 October 2025, Microsoft released its financial results for Q1 of fiscal year 2026, which ended on 30 September. The key figures, compared with the same period of fiscal year 2025, are as follows:

- Revenue: 77.7 billion USD (+18%)

- Net income: 30.8 billion USD (+22%)

- Earnings per share: 4.13 USD (+23%)

- Operating profit: 38.0 billion USD (+24%)

Revenue by segment:

- Productivity and Business Processes: 33.0 billion USD (+17%)

- Intelligent Cloud: 30.9 billion USD (+28%)

- More Personal Computing: 13.8 billion USD (+4%)

Microsoft started fiscal year 2026 with a very strong Q1: revenue grew by 18% y/y, operating profit increased by 24%, and non-GAAP EPS (excluding losses related to OpenAI) reached 4.13 USD (+23%). The key growth driver remained Microsoft Cloud – cloud revenue rose by 26%, Azure and other cloud services grew by 40%, and the commercial remaining performance obligations portfolio climbed by 51% to 392 billion USD.

The Productivity and Business Processes segment posted a 17% revenue increase, supported by sustained growth in Microsoft 365 and Dynamics 365. Intelligent Cloud grew by 28%, while More Personal Computing was up 4%, driven by a moderate recovery in Windows, devices, and search advertising. The gross margin remained strong at around 69%, although it declined slightly due to the capital-intensive nature of AI workloads. Meanwhile, the operating margin expanded to roughly 49% thanks to scaling high-margin cloud and software operations.

Microsoft finalised a new agreement with OpenAI under which the commercial arm has been structured as a public-benefit corporation – a for-profit entity with a defined public mission – further deepening the strategic partnership between the two companies. Management emphasised that Microsoft has effectively increased its investment nearly tenfold, while OpenAI has contracted approximately 250 billion USD in additional Azure services. Microsoft’s rights to joint revenue, as well as exclusive access to OpenAI models and intellectual property, are now valid until the achievement of AGI or at least until 2030. At the infrastructure level, the company is building what it describes as a planetary-scale cloud and AI factory, planning to expand its total AI capacity by more than 80% during the 2026 fiscal year.

On the product side, AI is deeply integrated across all business lines. According to management, around 900 million users per month now utilise AI-powered features, with more than 150 million people interacting with Copilot monthly, and Microsoft 365 Copilot, GitHub Copilot, and the new agents are being actively deployed across productivity, programming, cybersecurity, healthcare, and consumer applications.

Capital expenditure in Q1 FY 2026 surged to a record 34.9 billion USD, up from 24.2 billion USD in the previous quarter, as Microsoft continues to expand its GPU fleet and build new data centres. Despite this spike in CapEx, the company generated 45.1 billion USD in operating cash flow. Microsoft’s balance sheet remains robust, with around 102 billion USD in cash and short-term investments, total debt of roughly 43 billion USD, and a net cash position of approximately 59 billion USD, alongside more than 360 billion USD in total equity. In effect, this means that the company can fund its increased AI investments while continuing to make share buybacks and dividend payments, thereby maintaining a very strong financial position.

For the next quarter (Q2 FY 2026), management forecast total revenue in the range of 79.5–80.6 billion USD, which corresponded to year-on-year growth of 14–16%. The operating margin was expected to remain in line with the previous year, though slightly lower than in Q1 due to seasonal factors.

By segment, Productivity and Business Processes revenue was expected to reach 33.3–33.6 billion USD (+13–14% y/y).

The Intelligent Cloud segment was expected to come in at 32.25–32.55 billion USD (+26–27% y/y), with management noting that capacity constraints remained, as demand continued to outpace supply.

For More Personal Computing, the forecast was more modest at 13.95–14.45 billion USD. Revenue from Windows OEM and devices was expected to decline by a few percentage points, and Xbox content and services revenue was also expected to decrease slightly due to a strong prior-year comparison base.

Microsoft Corporation Q2 2026 financial results

On 29 October 2025, Microsoft released its Q1 2026 financial results for the period ended 30 September. Below are the key figures compared to the same period in the 2025 financial year:

- Revenue: 81.3 billion USD (+17%)

- Net income (non-GAAP): 30.9 billion USD (+23%)

- Earnings per share: 4.14 USD (+24%)

- Operating profit: 38.3 billion USD (+21%)

Revenue by segment:

- Productivity and Business Processes: 34.1 billion USD (+16%)

- Intelligent Cloud: 32.9 billion USD (+29%)

- More Personal Computing: 14.3 billion USD (–3%)

Microsoft Corporation’s Q2 2026 financial report exceeded analysts’ expectations across key financial metrics: revenue reached 81.3 billion USD, surpassing forecasts (around 80.2–80.3 billion USD), and earnings per share of 4.14 USD also exceeded consensus estimates (around 3.92–3.93 USD). The 17% year-on-year revenue growth was primarily driven by strong contributions from cloud services and AI integration, with the Intelligent Cloud segment growing by 29%, and Azure and related cloud services revenue increasing by 39% – the key driver behind the company’s accelerating growth.

During this quarter, the company saw a significant rise in expenses, especially capital expenditures (CapEx), which reached a record level of 37.5 billion USD (+66% year-on-year), driven by infrastructure investments in AI and data centre expansion. Operating and R&D expenses also increased, though operating costs rose more moderately, which helped improve margins in high-margin areas.

Microsoft management expects total revenue for Q3 2026 to be in the range of 80.65–81.75 billion USD (+15–17% year-on-year). Revenue from the Productivity and Business Processes segment is expected to be in the range of 34.25–34.55 billion USD (+14–15% year-on-year), from Intelligent Cloud 34.10–34.40 billion USD (+27–28% year-on-year), and from More Personal Computing 12.3–12.8 billion USD (–9–5% year-on-year).

The quarter showed mixed results across the divisions: Productivity and Business Processes and Intelligent Cloud remained strong growth drivers, while More Personal Computing saw a decline, partly due to a fall in gaming and hardware sales. However, efforts to diversify revenue streams (such as the growth in advertising and cloud subscriptions) helped offset this decline.

Fundamental analysis of Microsoft Corporation

Below is the fundamental analysis of MSFT based on the Q2 2026 financial results:

- Liquidity and access to financing: at the end of the quarter, Microsoft held 24.30 billion USD in cash and 65.17 billion USD in short-term investments, for a total of approximately 89.46 billion USD in highly liquid assets. Total current assets amounted to 180.19 billion USD, against current liabilities of 130.00 billion USD, implying a current ratio of around 1.4 – a comfortable level for a company with predictable cash flows and a large share of subscription-based revenue. Microsoft continues to maintain a top-tier AAA credit rating on its unsecured long-term debt, allowing it to access funding on highly favourable terms.

- Debt and leverage: the current portion of long-term debt stood at 4.83 billion USD, with long-term debt of 35.43 billion USD, bringing total interest-bearing liabilities to approximately 40.26 billion USD. Against cash and short-term investments of 89.46 billion USD, this results in a net cash position of roughly 49.20 billion USD.

Shareholders’ equity totalled 363.1 billion USD, compared with total liabilities of 273.3 billion USD and total assets of 636.4 billion USD. The gross debt-to-equity ratio is around 0.75, indicating a noticeable but not critical level of leverage. The debt structure is composed mainly of long-dated bonds with staggered maturities, which significantly reduces refinancing risk.

- Cash flow and dividend coverage: operating cash flow for Q2 2026 amounted to 35.76 billion USD, up from 22.29 billion USD a year earlier, representing year-on-year growth of 62%. Capital expenditure on property, plant, and equipment reached 29.88 billion USD, well above the prior-year level of 15.80 billion USD, confirming a sharp increase in spending on data centres and AI infrastructure. At the same time, total capital expenditure, including leased equipment and other non-cash components, is estimated at approximately 22.71 billion USD for the quarter, highlighting Microsoft’s aggressive capacity expansion to support AI workloads.

Importantly for shareholders, despite this elevated capex, Microsoft paid around 6.76 billion USD in dividends and repurchased an additional 7.41 billion USD of shares. In other words, current free cash flow covers dividends by more than five times, while total capital returns (dividends plus buybacks) are covered by free cash flow by roughly two and a half times, with a portion of FCF retained on the balance sheet.

Fundamental analysis for MSFT – conclusion

Microsoft is in exceptionally strong financial condition. The company combines a high level of liquidity, a net cash position, and access to the cheapest funding in the market, supported by its AAA credit rating. The key strength lies in cash generation: operating cash flow increased by more than 60% year-on-year, enabling Microsoft to invest aggressively in data centres and AI infrastructure while simultaneously returning substantial capital to shareholders. Even with sharply higher capital expenditure, dividends and buybacks are fully covered by free cash flow, with a wide margin of safety.

Overall, Microsoft appears financially robust and far removed from any balance sheet or solvency concerns. The primary risk is not financial, but rather the effectiveness and returns generated from its large-scale investments in AI infrastructure.

Analysis of key valuation multiples for Microsoft Corporation

Below are the key valuation multiples for Microsoft Corporation based on the Q2 2026 financial results, calculated using a share price of 433 USD.

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | Price paid for 1 USD of earnings over the past 12 months | 27.1 | ⬤ Below the IT sector average (~38). This indicates that the market perceives MSFT as less expensive on an earnings basis than many of its technology peers. |

| P/S (TTM) | Price paid for 1 USD of annual revenue | 10.6 | ⬤ Above the technology sector average (~8×), reflecting high growth expectations. |

| EV/Sales (TTM) | Enterprise value to sales, accounting for debt | 10.7 | ⬤ Microsoft trades at a premium to sales compared with most companies in the sector, reflecting strong expectations for revenue growth. |

| P/FCF (TTM) | Price paid for 1 USD of free cash flow | 41.6 | ⬤ A high premium to free cash flow relative to the sector, which increases the risk of a correction if FCF growth slows. |

| FCF Yield (TTM) | Free cash flow yield to shareholders | 2.7% | ⬤ Around the average level for high-growth companies and within the normal range for the technology sector. |

| EV/EBITDA (TTM) | Enterprise value to operating profit before depreciation and amortisation | 17.6 | ⬤ A moderately high valuation for a mature business. |

| EV/EBIT (TTM) | Enterprise value to operating profit | 22.8 | ⬤ In the short term, any signal of slowing growth or margin changes could affect the share price. |

| P/B | Price to book value | 8.2 | ⬤ A below-average P/B ratio compared with the technology sector. |

| Net Debt/EBITDA | Debt burden relative to EBITDA | 0.83 | ⬤ A moderate debt load, giving the company sufficient flexibility for financial manoeuvres. |

Microsoft valuation multiples analysis – conclusion

Overall, Microsoft is a financially resilient company with moderately high valuations that reflect expectations of strong earnings, revenue, and free cash flow growth. However, elevated multiples such as P/S, EV/Sales, and P/FCF indicate that the market has already priced in significant growth expectations, and any weak quarterly results or slowdown in growth may lead – and have already led (due to a slight decline in cloud margins) – to a correction in the share price.

At the same time, against the backdrop of a strong financial position, regular dividend payments, and an active share buyback program, Microsoft shares can be regarded as a defensive asset.

Expert forecasts for Microsoft Corporation stock for 2025

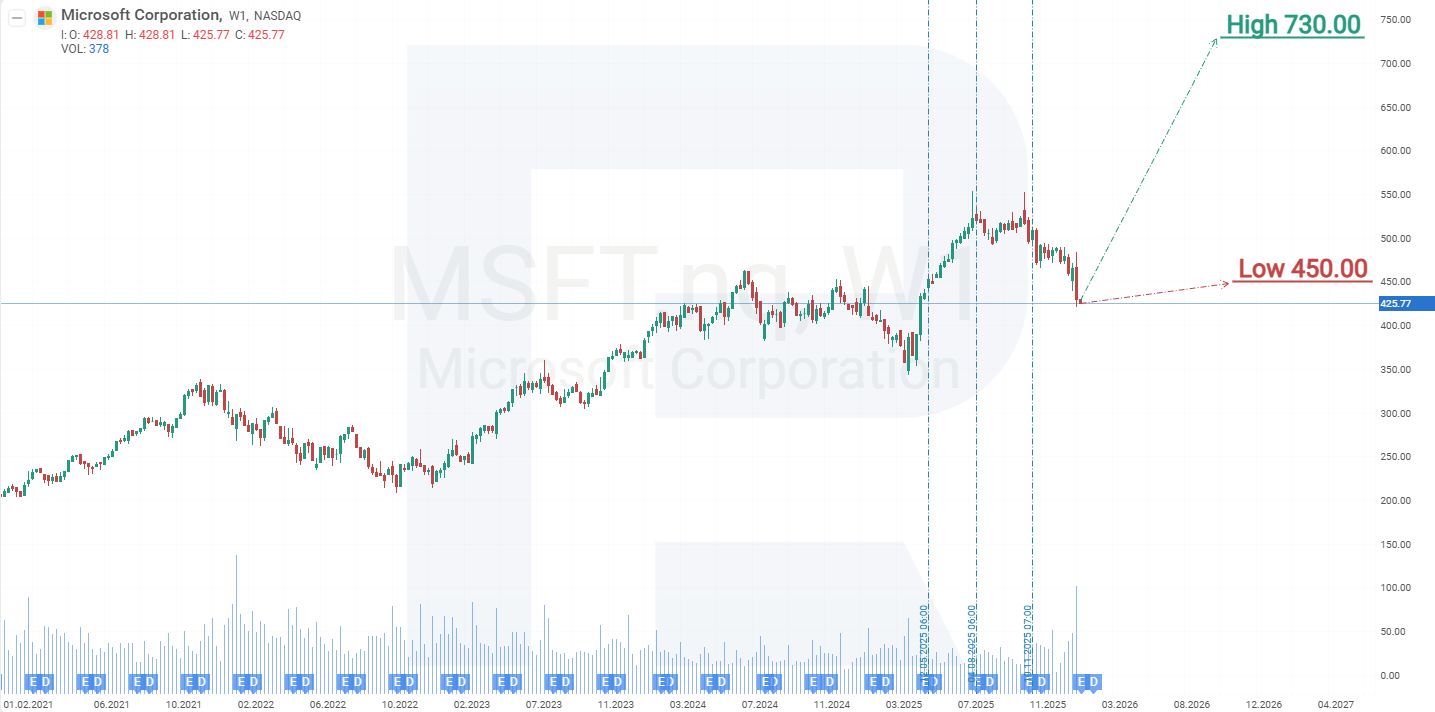

- Barchart: 41 out of 49 analysts rated Microsoft shares as Strong Buy, 5 as Moderate Buy, and 3 as Hold. The upper price target is 678 USD, and the lower bound is 450 USD.

- MarketBeat: 39 out of 42 analysts assigned a Buy rating to the shares, while 3 recommended Hold. The upper price target is 730 USD, and the lower bound is 450 USD.

- TipRanks: 34 out of 35 analysts rated the shares Buy, and 1 assigned a Hold rating. The upper price target is 678 USD, and the lower bound is 450 USD.

- Stock Analysis: 13 out of 34 analysts rated the shares as Strong Buy, 19 as Buy, and 2 as Hold. The upper price target is 675 USD, and the lower bound is 500 USD.

None of the analysts recommended selling Microsoft Corporation shares.

Expert forecasts for MSFT stock for 2026Technical analysis and 2026 forecast for Microsoft Corporation stock

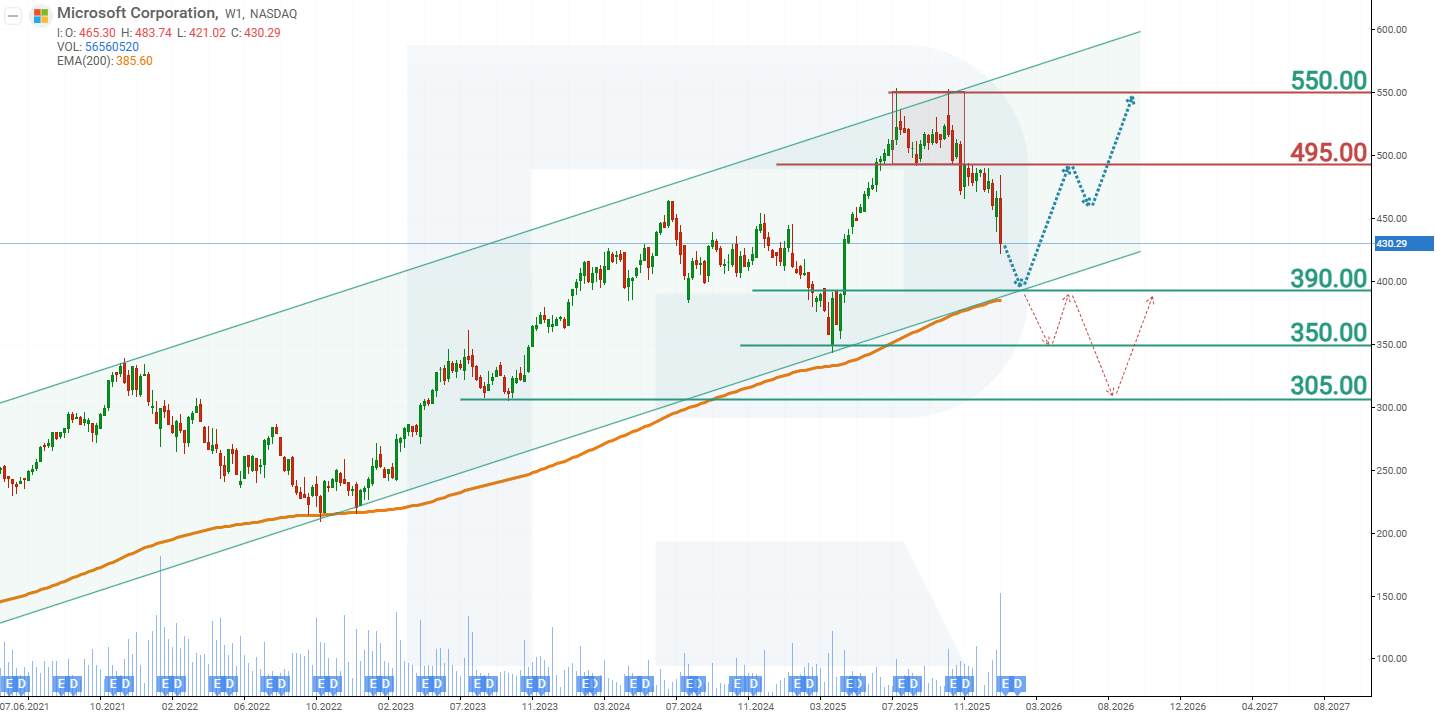

On the weekly chart, Microsoft Corporation shares are trading in an ascending channel and approaching the trendline, which serves as support. In October 2025, MSFT shares reached the upper line of the ascending channel at 550 USD and began to correct, falling 22% by February 2026. The proximity to the trendline signals a potential end to the correction and a resumption of the price rise within the upward trend. Based on the current performance of Microsoft Corporation shares, the possible price scenarios for 2025 are as follows:

The base-case forecast for Microsoft Corporation shares suggests testing the trendline at 390 USD, followed by a rebound and a recovery in prices within the upward trend towards resistance at 550 USD.

The alternative forecast for Microsoft Corporation shares suggests a break below the 390 USD support level. In this case, the trendline and the 200-day moving average would be breached, signalling the end of the uptrend. In this scenario, MSFT shares are expected to decline to 305 USD.

MSFT stock analysis and forecast for 2026Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.