Oracle: AI bet leads to rising debt and share price pressure

Oracle’s financial results for Q2 2026 confirmed continued growth in the cloud business but also highlighted a deepening FCF deficit and an increase in debt levels. The company’s shares remain under pressure amid doubts over its ability to sustain such large-scale investments in AI without undermining financial stability.

Oracle Corporation’s (NYSE: ORCL) report for Q2 of the 2026 financial year proved mixed. Revenue amounted to 16.06 billion USD (+14% y/y), coming in slightly below analysts’ expectations, while non-GAAP earnings per share reached 2.26 USD, noticeably above forecasts, partly due to one-off income from the sale of a stake in Ampere. The cloud segment continues to be the main growth driver, with total revenue from cloud services reaching 8.0 billion USD (+34% y/y), of which OCI infrastructure grew by around 66–68%, and cloud applications increased by approximately 11% y/y.

The situation with cash flows is weaker: over the past 12 months, operating cash flow amounted to 22 billion USD, which does not cover record capital expenditure on data centres (approximately 35–36 billion USD). As a result, free cash flow has turned negative, and debt continues to rise.

For Q3 of the 2026 financial year, the company forecasts revenue growth of 16–18% in constant currency (up to 19–21% in USD); however, the guidance for non-GAAP EPS is 1.64–1.68 USD, which is below the average market expectation (~1.72 USD). At the full-year 2026 level, Oracle maintains its revenue target of around 67 billion USD while raising its CapEx plan to 50 billion USD and continuing to invest heavily in AI infrastructure.

This article examines Oracle Corporation, outlines its business model, and provides a fundamental analysis for the Oracle financial report. It also includes a technical analysis of Oracle Corporation shares based on their current performance, from which a forecast for ORCL stock for 2026 is derived.

About Oracle Corporation

Oracle Corporation is an American technology company founded in 1977 by Larry Ellison, Bob Miner, and Ed Oates under the original name Software Development Laboratories. Initially, the headquarters were in Austin, Texas. After rebranding to Oracle in 1982, the company specialised in software development and cloud technologies, including database management systems (DBMS), enterprise software, cloud solutions, and infrastructure. The company is renowned for its flagship product, Oracle Database, and is also actively expanding its cloud services (Oracle Cloud), competing with AWS, Google Cloud, and Microsoft Azure.

Oracle went public on 12 March 1986 on the NASDAQ under the ticker symbol ORCL, becoming one of the first technology companies to list on the public market. Today, Oracle is one of the most prominent players in the enterprise technology industry, focusing on business digitalisation and cloud innovations.

Image of the company name Oracle CorporationOracle Corporation’s primary sources of revenue

Oracle’s primary sources of revenue are derived from the following business segments:

- Cloud Services and License: this is the largest revenue source, accounting for approximately 86% of total revenue. Oracle provides licences for its software products, such as Java, Oracle Applications, Oracle Database, Oracle Middleware, and others. This segment also includes cloud computing via the Oracle Cloud platform, encompassing IaaS (Infrastructure as a Service), PaaS (Platform as a Service), and SaaS (Software as a Service) models.

- Hardware: approximately 5% of revenue comes from the sale of hardware, including servers, storage systems, and specialised equipment. Production is outsourced to contract partners, with revenue further supplemented by software related to the hardware.

- Services: approximately 9% of revenue is generated from technical support and consulting services. This includes user support for Oracle software, updates, training, and assistance with solution integration. This segment is crucial for customer retention and ensuring stable financial inflows.

Oracle Corporation Q3 2025 financial results

On 10 March, Oracle Corporation released its Q3 2025 financial results for the period ended 28 February 2025. Below are the key figures:

- Revenue: 14.13 billion USD (+6%)

- Net profit: 4.23 billion USD (+6%)

- Earnings per share: 1.47 USD (+4%)

- Operating margin: 44.00% (unchanged)

Revenue by segment:

- Cloud services and licence support: 11.00 billion USD (+10%)

- Cloud revenue (IaaS plus SaaS): 6.20 billion USD (+23%)

- Cloud licence and on-premises licence: 1.12 billion USD (–10%)

- Hardware: 703.00 million USD (-7%) #. Services: 1.29 billion USD (–1%)

Oracle’s results for Q3 2025 present a mixed picture, reflecting both achievements and challenges.

Overall revenue of 14.10 billion USD fell short of the 14.40 billion USD forecast by analysts, indicating difficulties in meeting market expectations. Adjusted earnings per share amounted to 1.47 USD, below the expected 1.49 USD, signalling a decline in profitability. Furthermore, while revenue from Cloud services and licence support grew by 10%, it did not reach the anticipated 11.20 billion USD, indicating challenges with the full-scale monetisation of the cloud market.

On a positive note, the company entered strategic partnerships with OpenAI, Meta Platforms (NASDAQ: META), and NVIDIA (NASDAQ: NVDA), which, according to CEO Safra Catz, is expected to drive a 15% revenue increase in the 2026 financial year that starts in June of this year. In addition, Oracle plans to double its data centre capacity over the year to meet the growing demand for cloud services. Oracle has also invested in the Stargate project, which aims to develop cloud and network infrastructure for scalable computing and AI applications. For Oracle’s shareholders, the good news was the announcement of a 25% increase in quarterly dividends, raising them to 0.50 USD per share.

Oracle Corporation Q4 2025 financial results

On 11 June, Oracle Corporation released its Q4 results for the 2025 financial year, which ended on 31 May. Its key highlights are provided below:

- Revenue: 15.90 billion USD (+11%)

- Net income: 3.42 billion USD (+9%)

- Earnings per share: 1.70 USD (+4%)

- Operating margin: 44.00% (–300 basis points)

Revenue by segment:

- Cloud services and license support: 11.70 billion USD (+14%)

##. Cloud Revenue (IaaS plus SaaS): 6.70 billion USD (+27%)

- Cloud license and on-premises license: 2.01 billion USD (+9%)

- Hardware: 850.00 million USD (–2%)

- Services: 1.35 billion USD (–2%)

Oracle Corporation’s Q4 fiscal 2025 report demonstrated the company’s accelerating shift towards a cloud-centric business model. Total revenue rose by 11% year-on-year to 15.9 billion USD, with adjusted EPS reaching 1.70 USD, beating analysts’ expectations. Oracle Cloud Infrastructure (OCI) revenue growth of 52% to 3 billion USD was particularly notable, making this segment the company’s key growth driver.

Management emphasised the strength of Remaining Performance Obligations (RPO), which rose by 41% to 138 billion USD. CFO Safra Catz noted that this figure could more than double in fiscal 2026, providing strong visibility into future revenues. According to the company’s guidance, the cloud segment is expected to accelerate significantly next year, with total cloud revenue projected to rise by over 40% and OCI revenue by more than 70%.

Chairman of the Board and Chief Technology Officer Larry Ellison announced an aggressive expansion of Oracle’s global data centre network, including hundreds of new deployments across its Multi-Cloud and Cloud@Customer platforms. These initiatives, backed by a 25 billion USD investment program, strengthened Oracle’s position in the competitive landscape against major providers such as Amazon Web Services, Microsoft Azure, and Google Cloud. Additionally, the company is actively involved in generative AI initiatives, including providing infrastructure support for AI startups and potential involvement in projects such as the spin-off of TikTok in the US.

The company’s shares gained 14% following the report, which reflected growing investor confidence. Oracle is successfully transitioning from a traditional licensing model to one based on recurring cloud revenues. Nevertheless, investors should consider the company’s high debt burden and relatively elevated valuation multiples compared to competitors.

For fiscal 2026, the company forecasted revenue of at least 67 billion USD, which corresponds to annual growth of 16-17%. Alongside RPO growth and sustained demand for OCI, this forecast created the foundation for continued positive momentum. Thus, Oracle consolidated its status as a serious player in the enterprise cloud infrastructure market, and its strategic investments appeared capable of delivering long-term returns for shareholders.

Oracle Corporation Q1 2026 financial results

On 9 September, Oracle Corporation released its Q1 results for the 2026 financial year, which ended on 31 August. The key figures are as follows:

- Revenue: 14.93 billion USD (+12% year-on-year)

- Net income (non-GAAP): 4.28 billion USD (+8% year-on-year)

- Earnings per share (non-GAAP): 1.47 USD (+6% year-on-year)

- Operating margin: 42.00% (–100 bps)

Revenue by segment:

- Cloud: 7.19 billion USD (+28%)

- Software: 5.72 billion USD (–1%)

- Hardware: 670 million USD (+2%)

- Services: 1.35 billion USD (+7%)

Oracle maintained the guidance issued following its Q4 FY2025 report and delivered strong results in Q1 FY2026. Growth was driven primarily by cloud operations, particularly Oracle Cloud Infrastructure (OCI). Although revenue came in slightly below analyst forecasts, the report was received positively by the market, primarily due to the sharp increase in the contract backlog, which underpins future revenues. Total revenue stood at 14.93 billion USD, up 12% year-on-year but down 6% compared with the prior quarter. Non-GAAP operating profit rose to 6.24 billion USD, while net income reached 4.28 billion USD. GAAP EPS was 1.01 USD (down 2%), while non-GAAP EPS came in at 1.47 USD (+6%). Although just below expectations, a major positive was the surge in Remaining Performance Obligations (RPO) to 455 billion USD, up 359% from the previous year.

The revenue mix shifted further towards cloud. The cloud segment contributed 7.19 billion USD (+28% year-on-year), now accounting for nearly half of total revenue. Software revenue declined to 5.72 billion USD, while Hardware rose to 670 million USD and Services to 1.35 billion USD.

Capital returns to shareholders remain limited. In the quarter, Oracle repurchased about 0.4 million shares worth 93 million USD and declared its regular quarterly dividend of 0.50 USD per share, payable in October. Despite robust operating cash flow over the past twelve months (21.5 billion USD), the company is currently spending more than it generates: free cash flow over the same period was –5.88 billion USD. This reflects record investment in data centres, as Oracle rapidly expands capacity for cloud and AI workloads. In FY 2026, the company plans to spend approximately 35 billion USD on building out such infrastructure.

Management expects the cloud business to accelerate. In Q2 FY2026, Oracle forecasts total revenue growth of 12–14% in constant currency and EPS in the range of 1.61–1.65 USD. Cloud revenue is projected to rise by more than 30%. The company raised guidance for OCI separately: growth of 77% year-on-year is expected, to 18 billion USD, with a long-term target of 144 billion USD by FY2030. Oracle also reported large-scale collaborations with major cloud providers (Microsoft Azure, AWS and Google Cloud) and the construction of 71 joint data centres, 37 of which are already in the launch phase. Database revenue in the multi-cloud environment increased more than fifteenfold year-on-year. Among Oracle’s key partners are OpenAI, xAI, Meta, NVIDIA and AMD, all of which are actively using OCI for AI workloads.

Oracle Corporation Q2 2026 financial results

On 10 December, Oracle Corporation released its Q2 results for the 2026 financial year, which ended on 30 November. The key figures are as follows:

- Revenue: 16.06 billion USD (+14%)

- Net income (non-GAAP): 6.60 billion USD (+57%)

- Earnings per share (non-GAAP): 2.26 USD (+54%)

- Operating margin: 41.85% (–151 bps)

Revenue by segment:

- Cloud: 7.98 billion USD (+34%)

- Software: 5.88 billion USD (-3%)

- Hardware: 0.78 million USD (+7%)

- Services: 1.43 billion USD (+7%)

Oracle’s report for Q2 of the 2026 financial year proved mixed: earnings exceeded expectations, while revenue and guidance were slightly disappointing. Revenue increased by 14% year on year to 16.1 billion USD, coming in just below the market forecast (around 16.2 billion USD). Non-GAAP earnings per share amounted to 2.26 USD, significantly above expectations (~1.64 USD), largely due to one-off income from the sale of a stake in Ampere, which added 2.7 billion USD. Non-GAAP operating profit rose to 6.7 billion USD (+10% y/y), while net income increased to 6.6 billion USD (+57% y/y).

The main growth driver was the cloud business: total revenue from cloud services reached 7.98 billion USD (+34% y/y), of which infrastructure posted growth of 66–68% y/y to 4.1 billion USD, while cloud applications generated 3.9 billion USD (+11% y/y). At the same time, remaining performance obligations (RPO) surged to 523 billion USD (+438% y/y), including new large agreements with Meta (NASDAQ: META), NVIDIA (NASDAQ: NVDA), and others, confirming strong demand for Oracle’s AI infrastructure.

Cash flows and guidance were the weaker points of the report. Over the past 12 months, operating cash flow amounted to around 22.3 billion USD (+10% y/y). However, due to heavy investment in data centres (CapEx of 35.5 billion USD, including 12 billion USD in Q2), free cash flow turned negative at around –13 billion USD. Debt rose above 110 billion USD, raising concerns among investors.

The company continues to pay a stable quarterly dividend: the board of directors declared a dividend of 0.50 USD per share, with a record date of 9 January 2026 and a payment date of 23 January 2026. Over the first six months of the 2026 financial year, Oracle paid approximately 2.85 billion USD in dividends. This means that a significant portion of operating cash flow is being returned to shareholders, while the company simultaneously finances a massive investment program in cloud and AI infrastructure. Share buybacks during this half-year were modest: according to available data, Oracle repurchased its own shares for approximately 95 million USD, far less than dividend payments and the volume of debt raised. In effect, the current focus of capital returns is on dividends rather than aggressive share buybacks.

The company left its full-year revenue guidance unchanged at 67 billion USD, but provided cautious guidance for Q3: revenue growth of 16–18% in constant currency and earnings per share of 1.64–1.68 USD, which is below consensus expectations (1.72 USD). In addition, Oracle raised its annual capital expenditure plan to 50 billion USD (previously 35 billion USD), continuing to invest heavily in AI data centres. As a result, questions remain over the timing of a return to sustainably positive free cash flow.

Fundamental analysis for Oracle Corporation

Below is a fundamental analysis for ORCL based on the Q2 results of the 2026 financial year:

- *Cash flows and sustainability*: over the past 12 months, Oracle generated 22.3 billion USD in operating cash flow (+10% y/y), indicating that the core business continues to produce substantial cash from ongoing operations. However, against the backdrop of aggressive construction of data centres to support AI workloads, capital expenditure over the same period reached 35.5 billion USD, and cumulative free cash flow over the past four quarters turned negative at –13.2 billion USD.

Separately, over the first six months of the 2026 financial year, operating cash flow amounted to 10.2 billion USD, while CapEx reached 20.5 billion USD, resulting in negative free cash flow of –10.3 billion USD – meaning that the company is currently spending roughly twice as much on infrastructure build-out as it is generating in operating cash. This suggests that while the operating business itself remains sufficiently strong, the current level of investment clearly exceeds internal cash generation capacity, and negative free cash flow must therefore be covered by other sources of financing.

- *Balance sheet and debt burden*: as of 30 November 2025, Oracle held 19.8 billion USD in cash and equivalents, including marketable securities, against total assets of 205 billion USD. At the same time, total debt increased to 108.1 billion USD (8.1 billion USD in short-term borrowings and 100 billion USD in long-term debt), implying a net debt of approximately 88 billion USD – a cash-to-debt ratio of around 0.18 points to a high level of leverage. Over the six-month period, total debt rose from 92.6 billion USD to 108.1 billion USD following the issuance of 17.9 billion USD in senior notes in September, indicating that the company is actively raising debt to finance its CapEx program. The market is taking note: according to press reports, the cost of default insurance (CDS) and bond yields have been rising. While there are currently no formal signs of an imminent solvency risk, the debt burden is already elevated and continues to increase.

*Fundamental analysis for ORCL – conclusion*

From a financial sustainability perspective, Oracle is currently in an ambivalent position. On the one hand, the company has a strong operating business, double-digit revenue growth, a rapidly expanding cloud segment, a large portfolio of long-term contracts, and significant operating cash flow that, under normal conditions, would be sufficient to service debt comfortably and support moderate investment. On the other hand, the current level of CapEx directed towards AI data centres materially exceeds internal cash flows, resulting in deeply negative free cash flow and a noticeable increase in debt and financial risk. Fundamentally, Oracle remains far from an acute financial instability scenario: it retains access to capital markets, operates a growing business, and holds tangible infrastructure assets. However, the balance sheet buffer is no longer comfortable, and the sustainability of this model going forward depends on two key conditions: continued access to relatively cheap debt and the effective monetisation of AI investments through revenue and margin growth in the coming years. As a result, ORCL shares should currently be viewed not as a classic defensive, dividend-oriented asset, but as a company with a strong underlying business and clearly elevated financial risk due to aggressive debt-funded growth programs.

Analysis of key valuation multiples for Oracle Corporation

Below are the key valuation multiples for Oracle Corporation for Q2 of the 2026 financial year, calculated using non-GAAP metrics at a share price of 190 USD.

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | Price paid for 1 USD of earnings over the past 12 months | 35 | ⬤ A high level for a mature, large-scale software business, especially given that TTM earnings are inflated by one-off income from the sale of a stake in Ampere; excluding this factor, the underlying P/E would be even higher. |

| P/S (TTM) | Price paid for 1 USD of annual revenue | 8.9 | ⬤ Very high price-to-revenue multiple. |

| EV/Sales (TTM) | Enterprise value to sales, accounting for debt | 10.8 | ⬤ Taking into account the substantial debt burden, the business is valued at more than 10x annual revenue, which represents a very aggressive valuation. |

| P/FCF (TTM) | Price paid for 1 USD of free cash flow | n/a | ⬤ Free cash flow has been negative in recent quarters due to record CapEx spending on data centres. |

| FCF Yield (TTM) | Free cash flow yield to shareholders | Negative | ⬤ Oracle is burning cash to finance AI infrastructure. At present, there is no effective cash yield for shareholders. |

| EV/EBITDA (TTM) | Enterprise value to operating profit before depreciation and amortisation | 25 | ⬤ An extremely high multiple for a business of this size and stage of development. The market is paying a significant premium for AI-driven growth and the contract base, effectively pricing in many years of high margins. |

| EV/EBIT (TTM) | Enterprise value to operating profit | 30 | ⬤ Slower or less profitable payback from AI projects would leave virtually no margin of safety at such valuation levels. |

| P/B | Price to book value | 18 | ⬤ This represents a very large premium to the balance sheet, particularly against the backdrop of sharply rising debt. |

| Net Debt/EBITDA | Debt burden relative to EBITDA | 4.3 | ⬤/⬤ Debt is already above a comfortable level: while it remains serviceable for now, a decline in earnings or a prolonged period of negative FCF would turn it into a serious risk. |

| Interest Coverage (TTM) | Ability to cover interest expenses with operating profit | 7 | ⬤ Interest coverage is currently adequate, but with rising debt levels and borrowing costs, the margin of safety is gradually shrinking. |

Valuation multiples analysis for Oracle Corporation – conclusion

In terms of business scale and reported earnings, Oracle currently appears strong: TTM revenue exceeds 60 billion USD, net income and EBITDA are in the double-digit billions of USD, cloud and AI segments continue to expand, and the portfolio of future obligations has grown multiple times over the past year, including large contracts with OpenAI, Meta, NVIDIA, and others. At the same time, however, the company has entered a phase of aggressive investment: CapEx on data centres and AI infrastructure has surged, debt is rising rapidly, and free cash flow has remained negative for several consecutive quarters.

Against this backdrop, valuation multiples are firmly in the red zone: this is an expensive valuation even by the standards of a high-quality software giant. Net Debt/EBITDA is already approaching the upper end of the comfortable range, while FCF-based metrics look weak due to persistently negative cash flow.

As a result, at 190 USD per share, Oracle is a high-quality but heavily leveraged and expensive stock. The market is currently pricing it as if the massive investments in data centres and AI projects will pay off quickly and generate high returns. If this does not materialise, or if payback proves slower and less profitable than investors expect, the margin of safety at this valuation is minimal.

Why Oracle Corporation’s shares are falling

The decline in Oracle Corporation shares began after the release of the Q1 results for the 2026 financial year in September 2025. In isolation, the quarterly report appeared acceptable in terms of operating performance: revenue was growing at double-digit rates, the cloud business was showing strong momentum, and the portfolio of long-term contracts continued to expand. However, the market noted that, over a 12-month horizon, free cash flow had already turned negative due to exceptionally high capital expenditure on data centres, while operating cash flow was insufficient to cover investment at this scale.

As a result, following the September report, investor attention shifted towards Oracle’s funding structure and debt burden. This was quickly reflected in credit markets: according to available data, the spread on Oracle’s 5-year CDS doubled from September and reached 108 bp by the end of November, while CDS trading volumes surged from 200 million to 5 billion USD in just seven weeks. The company’s total debt already exceeds 104 billion USD, and Oracle plans to raise tens of billions more through syndicated loans to fund investments in AI infrastructure. At the same time, credit ratings from Moody’s (Baa2) and S&P (BBB) are only one notch above junk status and carry a negative outlook.

The situation was further exacerbated by the Q2 financial year 2026 report and related news flow. Oracle shares fell sharply following the release of the quarterly results. Market participants saw that CapEx had increased even further than previously expected, while free cash flow was already negative, reinforcing doubts over how long such a level of investment can be sustained without further debt accumulation and pressure on credit ratings. This was followed by reports of delays to some data centre projects that Oracle is building for OpenAI, which added further pressure on Oracle’s share price as well as on shares of other companies involved in AI infrastructure. Investors began to price in the risk of project timeline slippage and potential reallocation of orders. At the same time, Oracle’s credit risk index reached its highest level since 2009, serving as formal confirmation that credit markets now view the company as a riskier borrower than before. Against this backdrop, Oracle shares have fallen by around 45% from their autumn highs.

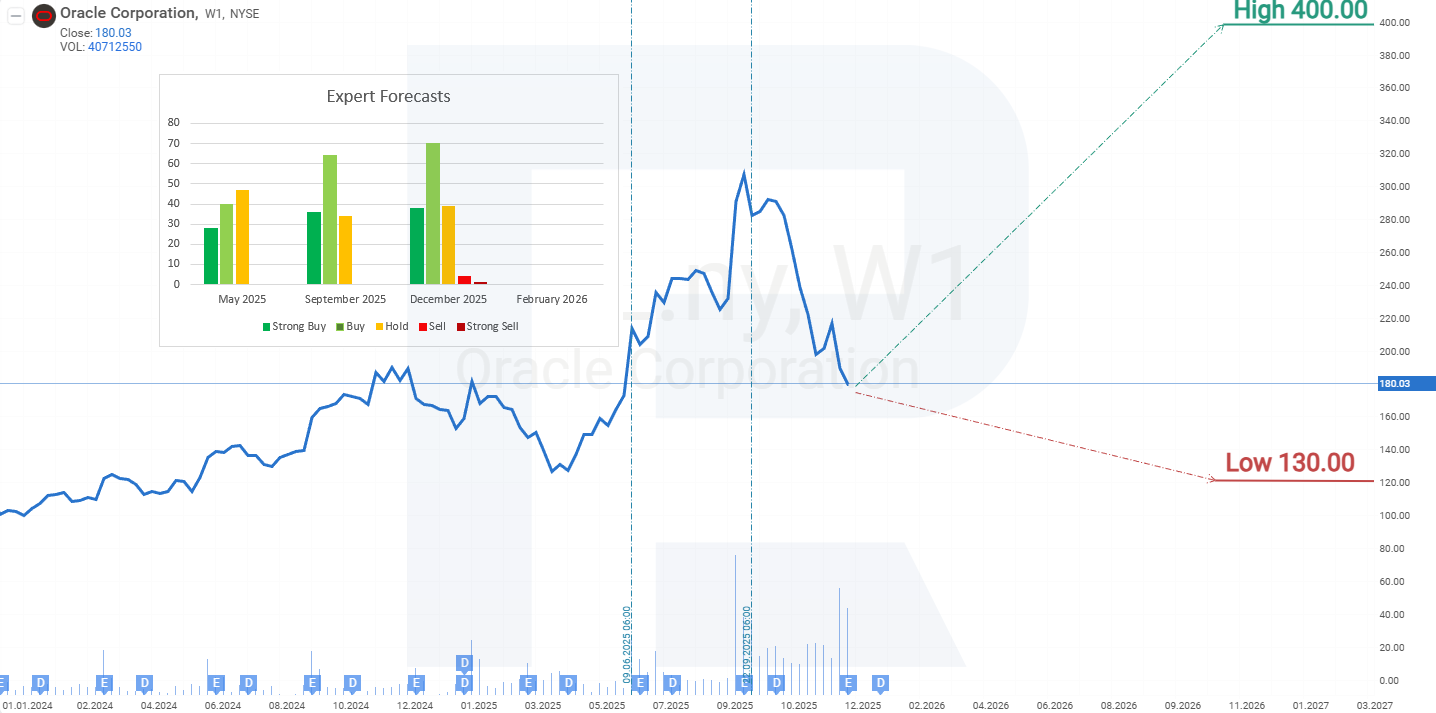

Expert forecasts for Oracle Corporation stock for 2025

- Barchart: 28 of 41 analysts rated Oracle Corporation shares as Strong Buy, 1 as Buy, 11 as Hold, and 1 as Sell. The upper price target is 400 USD, and the lower bound is 175 USD.

- MarketBeat: 30 of 43 analysts assigned a Buy rating to the stock, 11 issued Hold recommendations, and 2 rated it Sell. The upper price target is 400 USD, and the lower bound is 130 USD.

- TipRanks: 25 of 36 professionals recommended Buy, 10 advised Hold, and 1 recommended Sell. The upper price target is 400 USD, and the lower bound is 175 USD.

- Stock Analysis: 10 of 32 experts rated the shares as a Strong Buy, 14 as a Buy, 7 as Hold, and 1 as a Strong Sell. The upper price target is 400 USD, and the lower bound is 175 USD.

Oracle Corporation stock price forecast for 2026

From April to September 2025, ORCL shares rose by 193%, breaking through all key resistance levels and reaching an all-time high at 346 USD. Given the pace of this rally, the likelihood of a correction increased, and it did not take long to materialise. Rising debt levels and negative free cash flow unsettled investors, triggering sell-offs and a decline of around 48% from the historical high. As a result, the initially expected correction evolved into a sharp drop in ORCL’s share price. Based on the current performance of Oracle shares, the potential price scenarios for 2026 are as follows.

The base-case forecast for Oracle Corporation shares suggests a further decline towards support at 120 USD. At this level, demand may increase due to profit-taking by investors who had positioned for downside, potentially triggering a short-term rebound towards 195 USD. Subsequent price dynamics will depend on the company’s financial position: if debt continues to rise in the next quarterly report, a new wave of selling could drive the share price down to as low as 60 USD. Oracle’s annual dividend yield remains low at around 1%, and even if the share price fell to 60 USD, it would not exceed 3% at current payout levels. Such a yield is unlikely to attract income-focused investors, especially given the company’s rising debt, which could ultimately lead to a reduction or suspension of dividend payments. As a result, increased demand driven by dividends should not be expected, leaving debt levels as the key factor.

The alternative forecast for Oracle Corporation stock suggests a break above resistance at 195 USD. This outcome could materialise if the company returns FCF to positive territory in the next quarterly results. In that case, prices could move towards the next resistance level at 260 USD. However, further upside would be constrained, as market participants would require confirmation of sustainable FCF growth in subsequent quarters. As such, trading within the 220–260 USD range appears likely. With continued improvement in financial metrics, ORCL shares could break above 260 USD and once again approach the historical high at 346 USD.

Oracle Corporation stock analysis and forecast for 2026Risks of investing in Oracle Corporation stock

Investing in Oracle Corporation’s shares is associated with several risks that could negatively affect the company’s revenues and impact its investors. Below are the main risks:

#.*Intense competition in cloud computing*: Oracle faces fierce competition from giants such as Alphabet Inc. (NASDAQ: GOOG), Amazon.com, Inc. (NASDAQ: AMZN), and Microsoft Corporation (NASDAQ: MSFT), which dominate the cloud technology market. If Oracle fails to implement innovations fully and offer competitive pricing, it may lose market share, thereby reducing its revenues.

#.*Economic downturns*: Oracle’s business model is oriented towards enterprises and depends on corporate IT budgets. During recessions or economic slowdowns, companies may delay or cut back on spending for software, cloud services, or hardware upgrades, which would directly affect Oracle’s revenues.

#.*Limited infrastructure scalability*: with rapidly growing demand for cloud services, particularly from AI-related projects, Oracle may face a shortage of computing capacity. Despite the announced data centre expansion plans and significant capital investment, the process of ramping up infrastructure takes time and resources. This may delay the execution of contracts and revenue recognition and even lead to client attrition to competitors with more scalable architectures. As a result, short-term revenue growth may be limited despite strong demand.

#.*Infrastructure constraints and execution risks for AI projects*: amid explosive demand for cloud and AI services, Oracle is aggressively expanding its data centre capacity, but the construction and commissioning of infrastructure take time and require substantial capital outlays. The company is already facing delays in certain AI-focused data centre projects, including those for major clients such as OpenAI. This creates risks of delayed contract execution, delayed revenue recognition, and a potential reallocation of some demand to competitors that can scale infrastructure more quickly.

#.*Rising debt burden and credit risk*: to finance AI investments, Oracle has issued tens of billions of USD in bonds in recent years, pushing total debt above 100 billion USD, while free cash flow has turned negative amid record CapEx. The company is becoming increasingly dependent on external financing, and bondholders require regular fixed payments, unlike shareholders, who may tolerate negative FCF in anticipation of future growth. Against this backdrop, the cost of default insurance for Oracle (CDS) has risen to its highest level since 2009, reflecting an elevated market perception of credit risk. If conditions in debt markets deteriorate, the company may be forced to cut back on CapEx, slowing the rollout of AI infrastructure, or raise capital on less favourable terms.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.