JP 225 forecast: the index has completed its correction

The JP 225 stock index has completed its correction after reaching a new all-time high and is poised to climb higher. The JP 225 forecast for today is positive.

JP 225 forecast: key takeaways

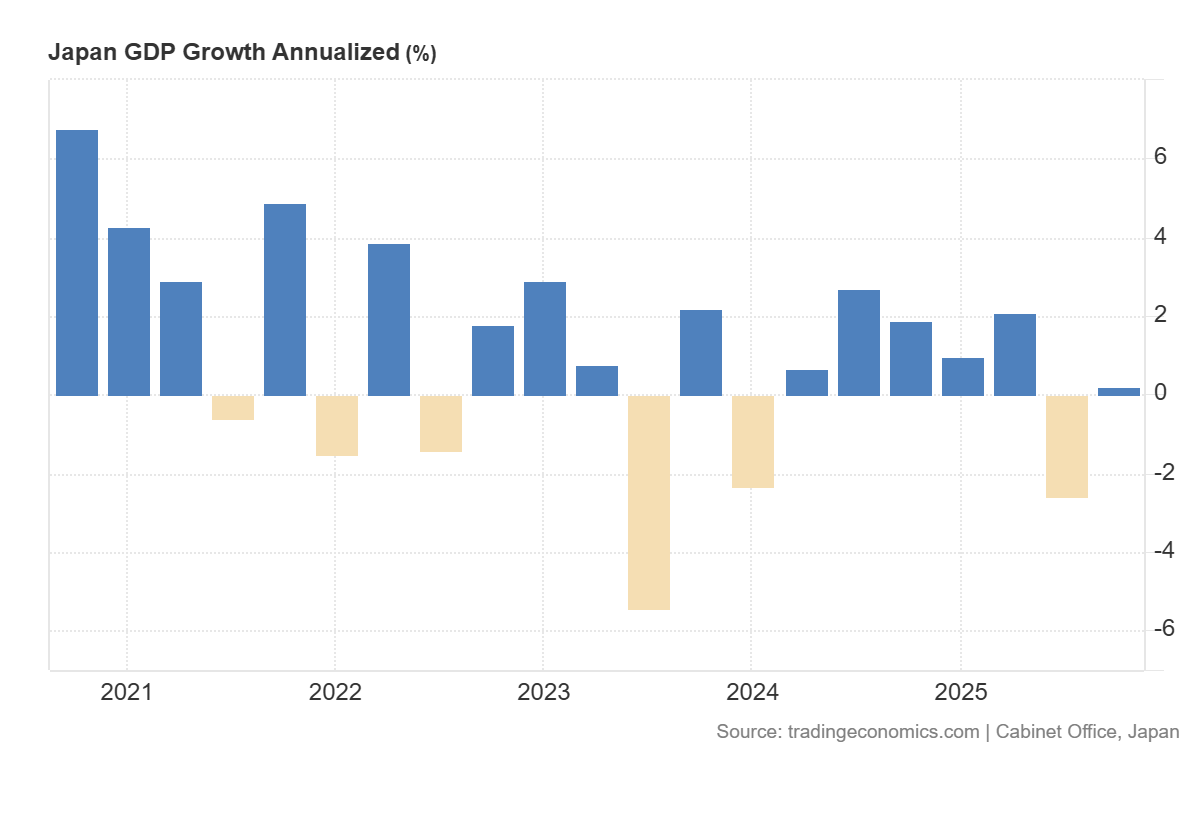

- Recent data: Japan’s GDP growth for Q4 2025 came in at 0.2% year-on-year

- Market impact: the effect on the Japanese equity market is moderately negative

JP 225 fundamental analysis

The published Japanese GDP data, at 0.2% year-on-year, compared to expectations of 1.6%, indicates a significantly weaker economic recovery than the market had anticipated. For the JP 225 index, this typically forms a moderately negative initial signal, as expectations for revenue growth among companies focused on domestic demand deteriorate and investor caution increases regarding the coming quarters. Such statistics are perceived as confirmation that economic activity remains fragile and sensitive to cost-of-living factors and consumption dynamics.

According to Goldman Sachs, hedge funds have purchased the bulk of Asian equities over the past decade. Last week, emerging and developed Asian markets recorded the largest net hedge fund inflows since 2016, supported by optimism surrounding companies involved in artificial intelligence infrastructure.

Japan’s GDP growth annualised: https://tradingeconomics.com/japan/gdp-growth-annualizedJP 225 technical analysis

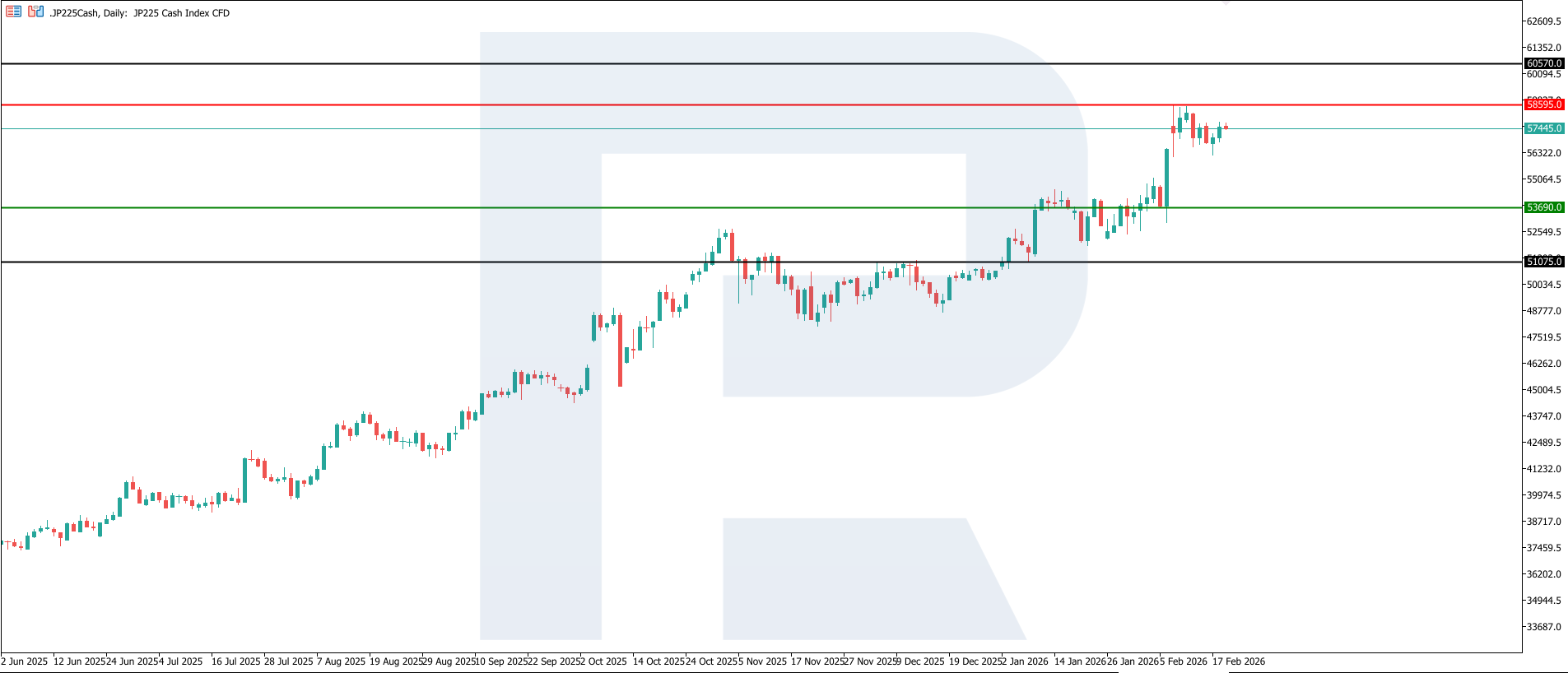

The JP 225 index maintains its upward trajectory, with the key support level at 53,690.0 and the nearest resistance level around 58,595.0. The current rise is highly likely to be medium-term, with the next potential target at 60,570.0.

The JP 225 price forecast considers the following scenarios:

- Pessimistic JP 225 scenario: a breakout below the 53,690.0 support level could send the index down to 49,705.0

- Optimistic JP 225 scenario: a breakout above the 58,595.0 resistance level could boost the index to 60,570.0

Summary

The data is unfavourable for assessing the state of domestic demand and short-term economic momentum; however, it also increases the likelihood of supportive financial conditions, thereby reducing the risk of a sharp deterioration in the JP 225 index. In the near term, a moderately volatile and selective market scenario appears most probable, where direction will depend more on the combination of currency dynamics, Bank of Japan policy expectations, and the quality of earnings reports from major export-oriented companies, rather than on broad sentiment. The next upside target for the JP 225 stands at 60,570.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.