Japanese Candlesticks Analysis 21.06.2022 (USDCAD, AUDUSD, USDCHF)

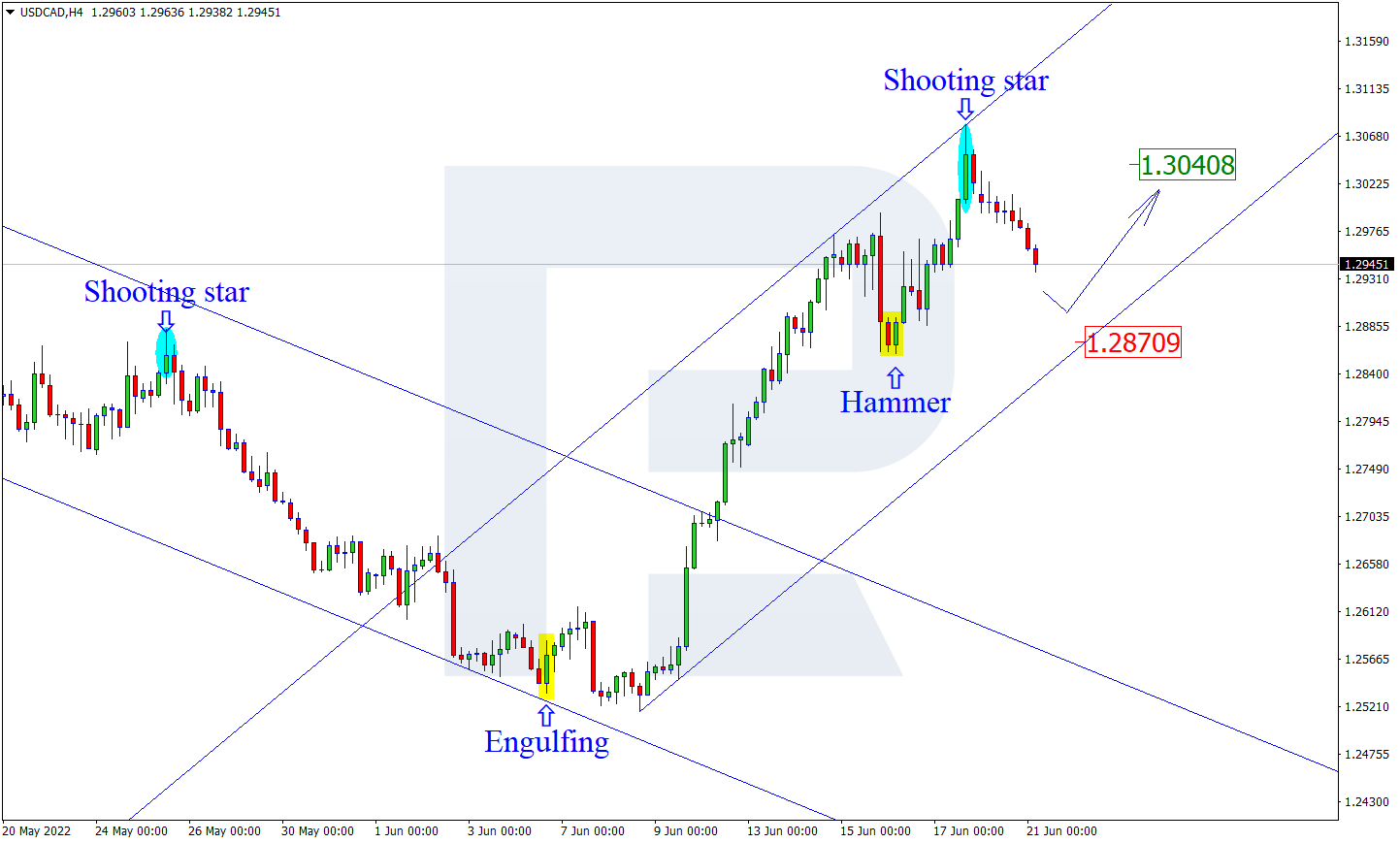

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the H4 chart, after forming a Shooting Star reversal pattern close to the resistance level, USDCAD may reverse in the form of another descending impulse. In this case, the downside target may be the support area at 1.2870. Later, the market may rebound from this level and resume growing. However, an alternative scenario implies that the asset may continue trading upwards and reach 1.3040 without testing the support area.

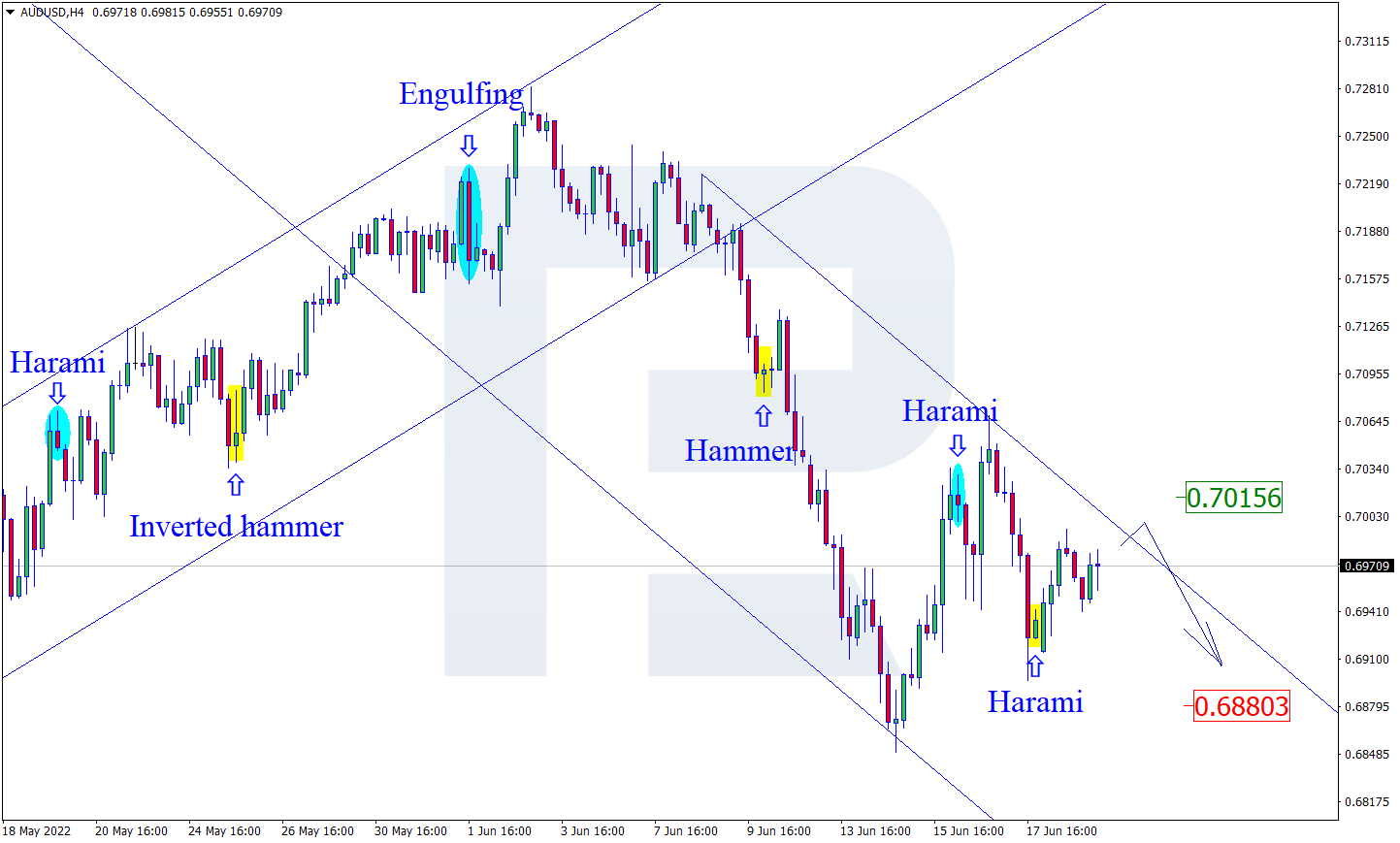

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, AUDUSD has formed a Harami reversal pattern near the support level. At the moment, the asset is reversing and starting a new rising impulse. In this case, the upside target may be the resistance level at 0.7015. After testing the level, the price may rebound from it and resume the descending tendency. At the same time, the opposite scenario implies that the price may continue falling to reach 0.6880 without any corrections.

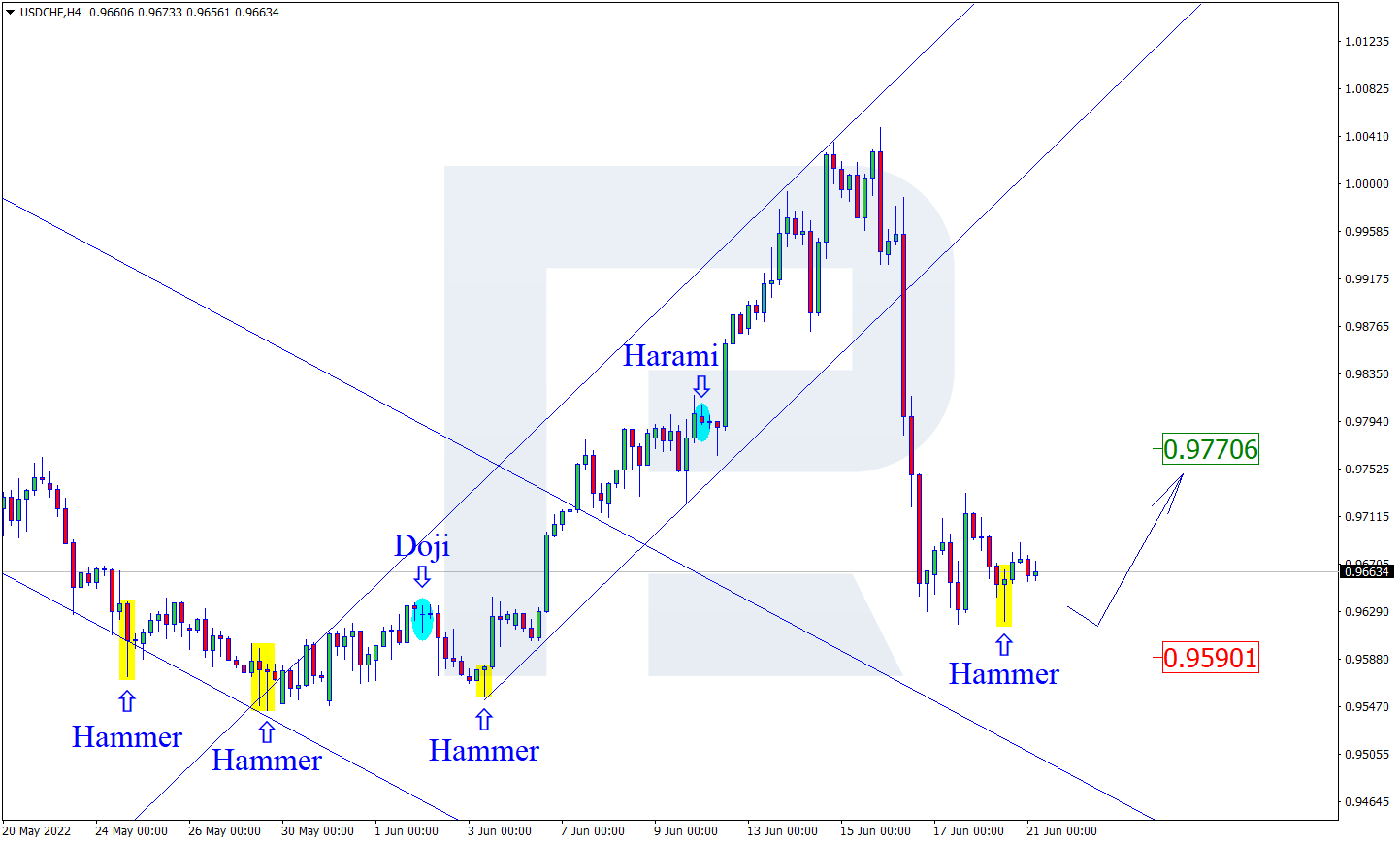

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, after testing the support area, the pair has formed a Hammer reversal pattern. At the moment, USDCHF may reverse in the form of a new ascending impulse. In this case, the upside target may be at 0.9770. After testing the resistance level, the price may break it and continue trading upwards. Still, there might be an alternative scenario, according to which the asset may fall to reach 0.9590 and continue the descending tendency without any pullbacks.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.