Fibonacci Retracements Analysis 08.09.2020 (EURUSD, USDJPY)

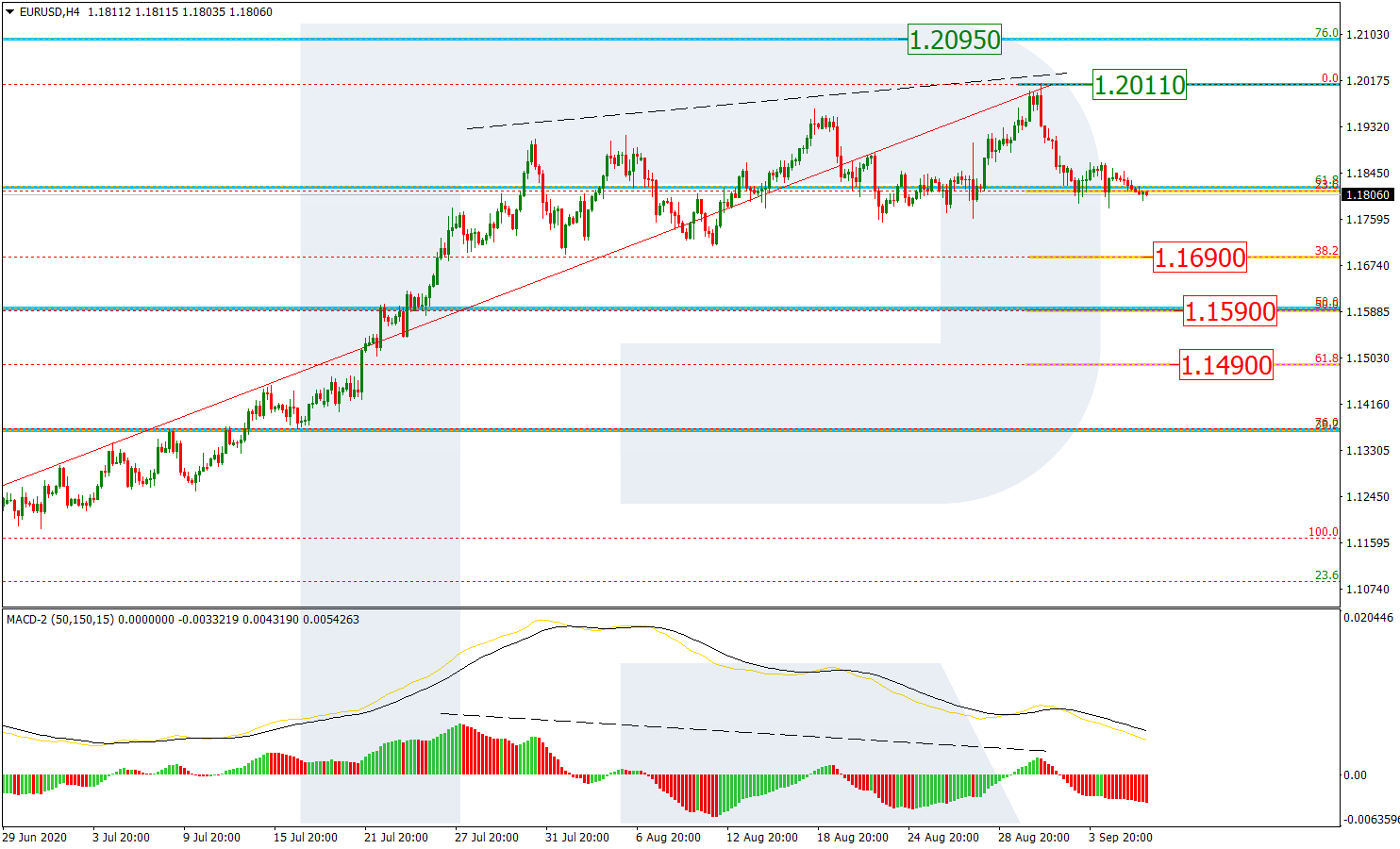

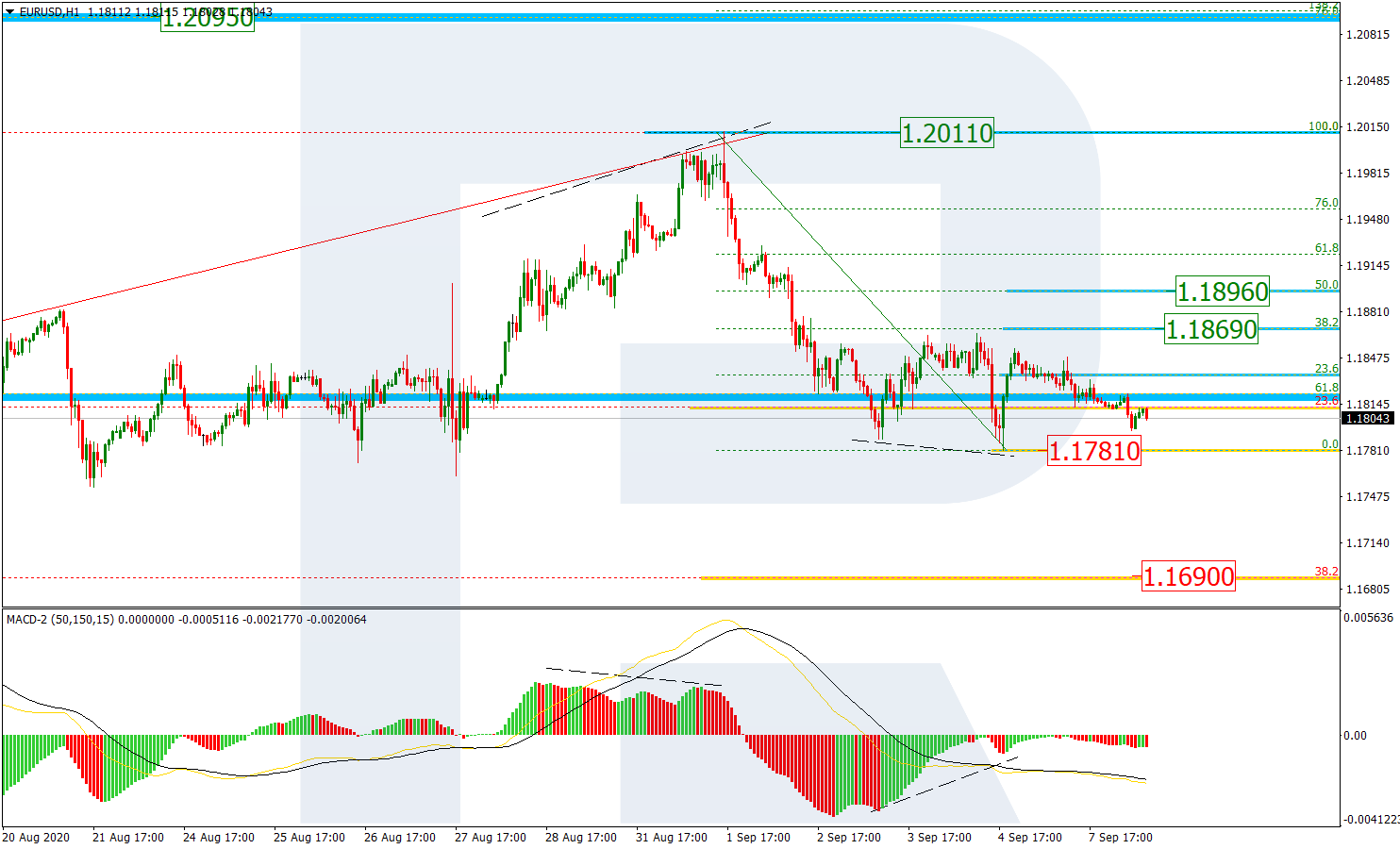

EURUSD, “Euro vs US Dollar”

On H4, the pair renewed the previous high, tested the psychological resistance level of 1.2000, and started correcting after a divergence on the MACD. By now, the quotations have reached 23.6% Fibo of the last wave of growth. Further declining will be aimed at 38.2% (1.1690), 50.0% (1.1590), and 61.8% (1.1490). A breakaway of the resistance line and the high at 1.2011 will let the quotations rise to the long-term level of 76.0% (1.2095).

On H1, there is a local pullback after a short-term divergence. The pullback reached 23.6% Fibo but may proceed to 38.2% (1.1869) and 50.0% (1.1896). A breakaway of the local low at 1.1781 will let the quotations go down to 38.2% (1.1690).

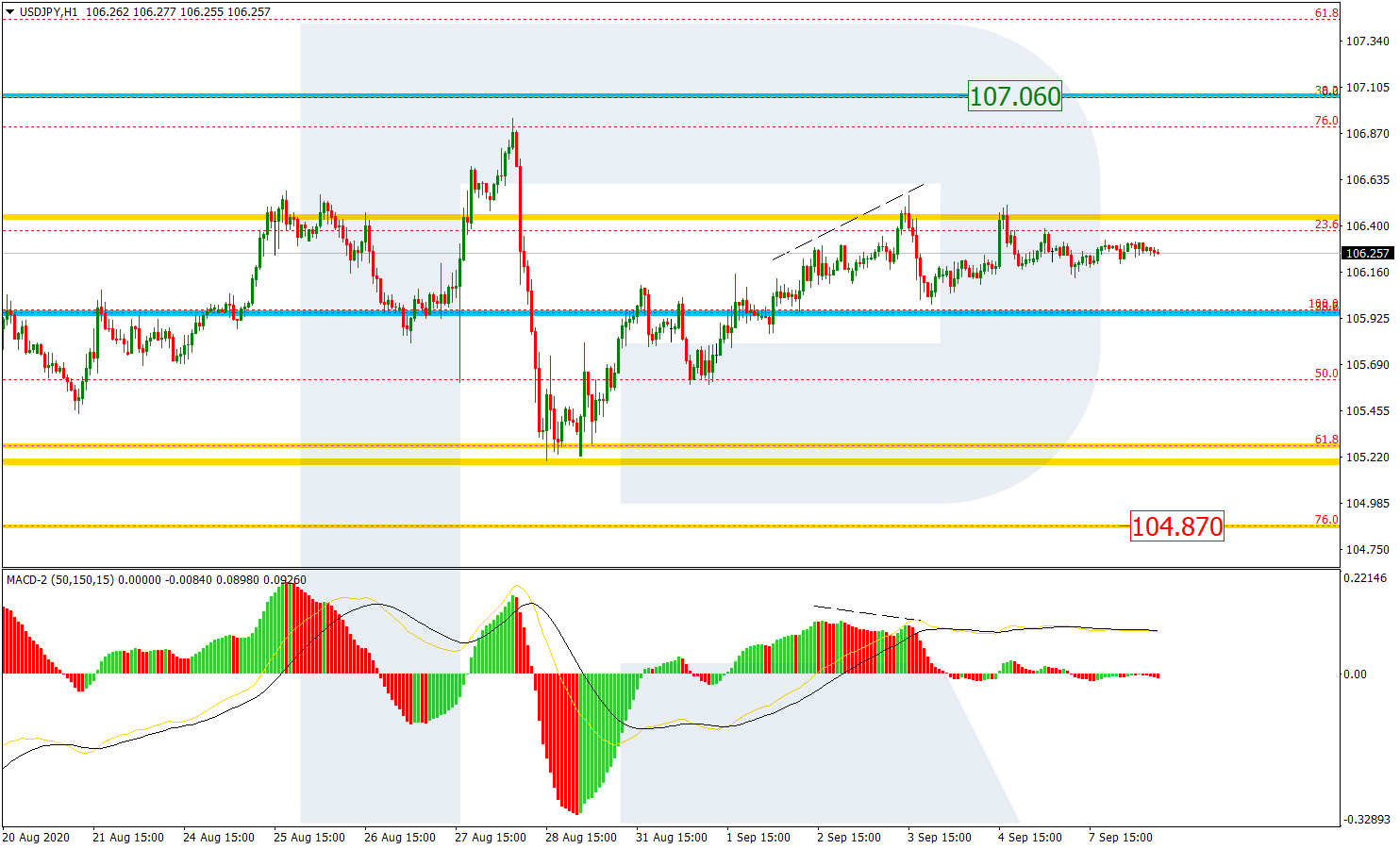

USDJPY, “US Dollar vs. Japanese Yen”

On H4, the quotations remain in a sideways flat after a wave of growth. The quotations keep moving between 50.0% and 61.8% Fibo, trying to test 38.2% (107.06). If the market manages to test and break through this level, the next movement will aim at breaking away 50.05% (107.94) and 61.8% (108.83). A breakaway of the fractal support at 104.18 will open the pathway to the long-term level of 76.0% (103.70).

On H1, the wave of growth in the flat ends in a divergence and forms a consolidating Triangle that may transform into a wave of correctional decline to 76.0% (104.87) and then to the fractal low of 104.18.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.